The Scotiabank Gold American Express Card has become one of the most intriguing credit cards in the Canadian market.

As its rewards program, Scene+, continues to emerge as a stronger player in the loyalty landscape, the value proposition and the ways to maximize this card are greater than ever before.

With heightened category multipliers and a time-sensitive elevated welcome bonus, let’s look at nine reasons why the Scotiabank Gold Amex should be in your wallet.

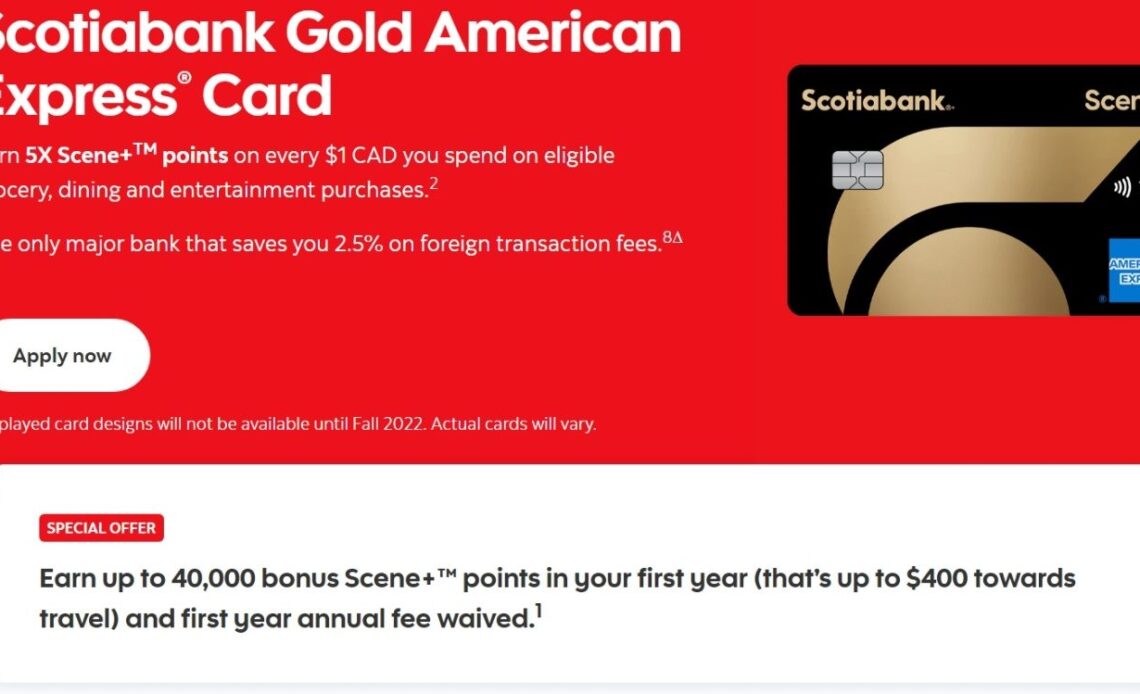

Scotiabank Gold American Express Card

- Earn 20,000 Scene+ points upon spending $1,000 in the first three months

- Earn an additional 20,000 Scene+ points upon spending $7,500 in the first year

- Earn

1x5x Scene+ points on groceries, dining, and entertainment - Also, earn

1x3x Scene+ points on gas, transit, and select streaming services - Redeem points for statement credit for any travel expense

- No foreign transaction fees

- Enjoy the exclusive benefits of being an American Express cardholder

- Annual fee: $0 in the first year, then $120

1. 40,000 Scene+ Points Welcome Bonus

By applying prior to October 31, 2022, you’re eligible to receive a total welcome bonus of 40,000 Scene+ points. The process of earning the welcome bonus involves two easy steps:

- 20,000 Scene+ points upon spending $1,000 in the first three months

- Another 20,000 Scene+ points upon spending at least $7,500 in your first year

In other words, you’ll only need to spend an average of $625 per month to receive the full welcome bonus of 40,000 Scene+ points.

40,000 Scene+ points is equivalent to $400 towards travel expenses, and is one of the highest signup bonuses we’ve seen on the Scotiabank Gold Amex Card.

Even though the spending requirement of $7,500 in the first year might appear high at first glance, there are quite a few compelling reasons why you’ll organically want to put a lot of spend on this card, as we’ll discuss below.

2. First Year Free

Typically, the Scotiabank Gold Amex Card comes with a reasonable annual fee of $120. However, if you apply before October 31, the annual fee is waived for the first year.

Meanwhile, we’ve recently seen comparable credit cards in the mid-range travel market increase…

Click Here to Read the Full Original Article at Prince of Travel…