Something to consider when choosing a credit card is the strength of its travel insurance benefits. Frequent travellers often look to their credit cards for protection and reimbursement when something unexpected occurs on their trips, be it flight delays, baggage delays, trip cancellation or interruption, or major accidents and medical emergencies.

A widely-held belief regarding credit card insurance is that it only applies if the full cost of the trip is charged to the card. So, if you were purchasing a flight on the airline’s website, you’d have to pay for the flight using a certain card for that card’s insurance benefits to kick in.

But what happens when you redeem miles for travel? How can you take advantage of your credit card’s insurance benefits when you’re travelling on an award ticket? The answer varies from card to card, and can even be different depending now which type of insurance coverage you’re looking at.

Let’s take a closer look at credit cards that offer insurance for award travel.

Emergency Medical Insurance: Just By Being a Cardholder

Whether or not a credit card offers emergency medical insurance is what often distinguishes the stronger insurance packages from the weaker ones.

However, what many people might not realize is that the majority of cards that come with travel medical insurance do not require you to charge the cost of the trip to the card for the coverage to kick in.

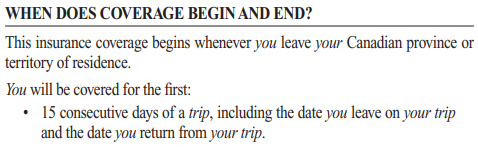

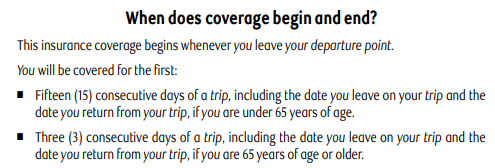

Rather, to be eligible for medical insurance, you simply need to be leaving your province of territory of residence on a trip whose duration does not exceed a certain number of covered days. The number of covered days varies from card to card, but is usually 15–25 days if you’re below age 65, and much less if you’re 65 or older.

For example, the Amex Platinum Card’s insurance pamphlet specifies the following:

The RBC Avion Visa Infinite’s pamphlet specifies the following:

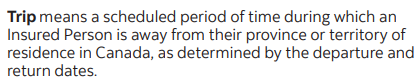

And the Scotiabank Passport Visa Infinite’s benefits booklet defines “trip” as the following:

As you can see, travelling outside of your province or territory of residence is all that’s required for the emergency medical insurance to kick in, and there’s no requirement for the trip’s costs to be charged to the card itself.

This is the case for almost every card out there that includes medical insurance, including the American Express Gold Rewards Card, the American Express…

Click Here to Read the Full Original Article at Prince of Travel…