On November 1, 2022, Stack Prepaid Mastercard holders were jolted with unpleasant news from the groovy fintech.

Going forward, the company which has advertised itself as a “disruptive” David against the oligopolistic Goliath of Big 5 mainstream banking is going to be falling back on the oldest trick in the financiers’ cookbook: levying fees on members.

Let’s look at the changes and ponder how the righteous have fallen so far from grace.

A History of Devaluations

Negative modifications to Stack’s product are nothing new. In hindsight, this prepaid card may have been too good to be true, and perhaps the cutbacks occurring now are a direct result of that.

The reason for this is because Stack truly used to be a trailblazer: it offered no foreign transaction fees on forex purchases and ATM withdrawals.

It had the occasional discount on certain products and services (as many fintechs do) via reciprocal partnerships with specific merchants. And it continues to maintain the useful (but more prevalent) virtual card feature.

But oh, vanity of vanities, how the might Stack has fallen.

The card has had the dreaded 2.5% FX fees since February of 2022. The partnerships, thin as they were, almost completely dried up.

The app would harangue you to load money should you neglect to use it for a few months. And now the worst is coming to pass for Stack cardholders….

Time to Eject

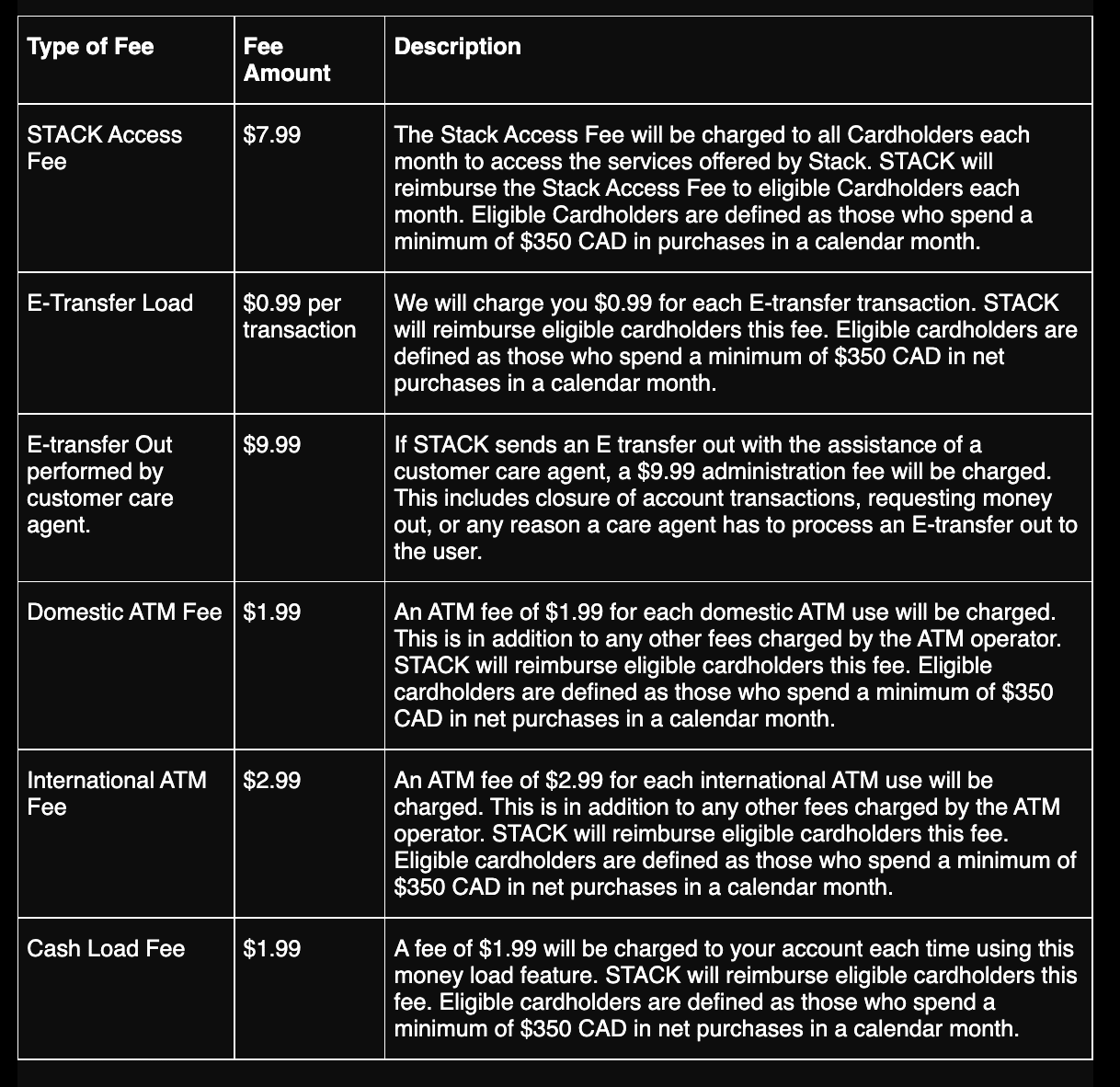

As of December 1, 2022, there are a series of arbitrary fees that Stack users will be subject to, and boy do these look almost exactly like the banking fees the card was specifically designed to disrupt!

(If you applied for Stack between October 1 and November 30, 2022, the new fees will apply as of January 1, 2023.)

As we covered back in February, Stack places a huge amount of its brand cachet on no-fee ATM withdrawals. With these changes, that positive attribute is going to its grave, and domestic ATMs will cost $1.99 per transaction, with foreign ATMs requiring $2.99 in fees.

Previously, e-transfers were free. Now, they’re $0.99 per transaction. Similarly, there’s a monthly subscription fee of $7.99 for the “privilege” of continuing to use this product.

Most of the above fees can be waived if you have $350 in net purchases in month. This is a very key difference from banks, who want you to keep money deposited with them so they then have collateral to give out loans. On the other hand, prepaid…

Click Here to Read the Full Original Article at Prince of Travel…