Whether your strategy revolves around welcome bonuses, everyday earn rates, or perks for cardholders, the best credit cards generally have the highest annual fees.

If the value is there, it’s worth shelling out for premium cards. But given the choice, we’d always prefer to reduce those costs whenever possible.

First year free is great, but it isn’t forever. We can use signup incentives to justify our new credit cards, but what about our keepers?

Luckily, the banks know they need to provide ongoing value to keep fee-paying cardholders on the hook year after year. Some cards have annual credits which offset the annual fee, either partially or entirely. This makes the decision to keep the card a lot easier.

American Express Platinum Card: $200 Travel Credit

The big kahuna of the Canadian credit card scene, the American Express Platinum Card, has some of the best benefits in the business.

You get 3 Membership Rewards points per dollar spent on dining, a complimentary Priority Pass membership with unlimited visits to airport lounges for you and one guest, automatic hotel status including Marriott Bonvoy Gold Elite and Hilton Honors Gold, and strong travel insurance.

I’d also venture that the Amex Platinum is the standard-bearer among Canadian credit cards as a status symbol. Whether or not that moves the needle for you, you can’t deny that the card is flashy, or that its exclusivity and branding have value.

To justify these perks, the card commands the steepest annual fee, at $699. However, once you’ve gotten over the sticker shock, you’ll notice that the card has a $200 annual travel credit.

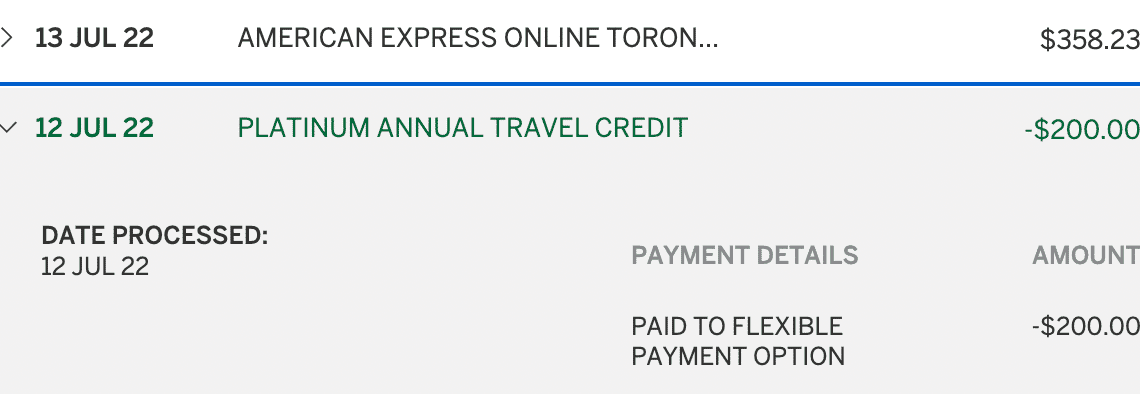

This credit is extremely flexible and easy to use. You can apply it to any flight, hotel, car rental, or vacation package booked through American Express Travel Online or the Platinum Card Travel Service over the phone.

You have to use the credit when you make the booking – it can’t be applied later – but it won’t be reversed if your plans change and you have to cancel.

Because of its versatility, I’d consider this credit as good as cash. This brings the net annual fee down to $499.

That’s still a crazy high fee for a keeper card, but it’s actually lower than other top-tier cards. The TD Aeroplan Visa Infinite Privilege, the CIBC Aeroplan Visa Infinite Privilege, and the American Express Aeroplan Reserve Card all have higher net fees, at $599.

If you prefer the…

Click Here to Read the Full Original Article at Prince of Travel…