It’s a piece of personal finance wisdom that has become ingrained as gospel: avoid hurting your credit score at all costs. Without a strong credit history, it’s harder to get approved for credit cards and other types of loans.

Credit cards present an excellent opportunity to earn rewards, and each new card comes with a new bonus. But the act of applying for credit momentarily hurts your credit history, which hurts your ability to apply for the next card.

Fortunately, there are a few ways to avoid credit inquiries when applying for a new card, and to minimize the impact of credit inquiries when you do have to incur them.

What Is a Credit Inquiry?

There are two credit bureaus in Canada: Equifax and TransUnion. Whenever you open a credit account (such as a credit card, mortgage, or loan), the lender reports your credit activity to the credit bureaus. The bureaus keep track of your personal credit history, including payment history, credit limits, and credit-seeking events, among other things.

When you apply for new credit, the lender pings one or both of the credit bureaus for this information. They use your existing credit file to assess your creditworthiness at that time. This is called a credit inquiry.

Inquiries are tracked on your credit history as credit-seeking events. When a lender performs an inquiry, they’ll see all past inquiries on file. And when you apply for another card in the future, that issuer will see an inquiry from today.

You can view your credit report for free, to track what the bureaus track and see what the banks see. You can access your TransUnion report at CreditKarma and your Equifax report at Borrowell.

How Do Inquiries Affect Your Credit Score?

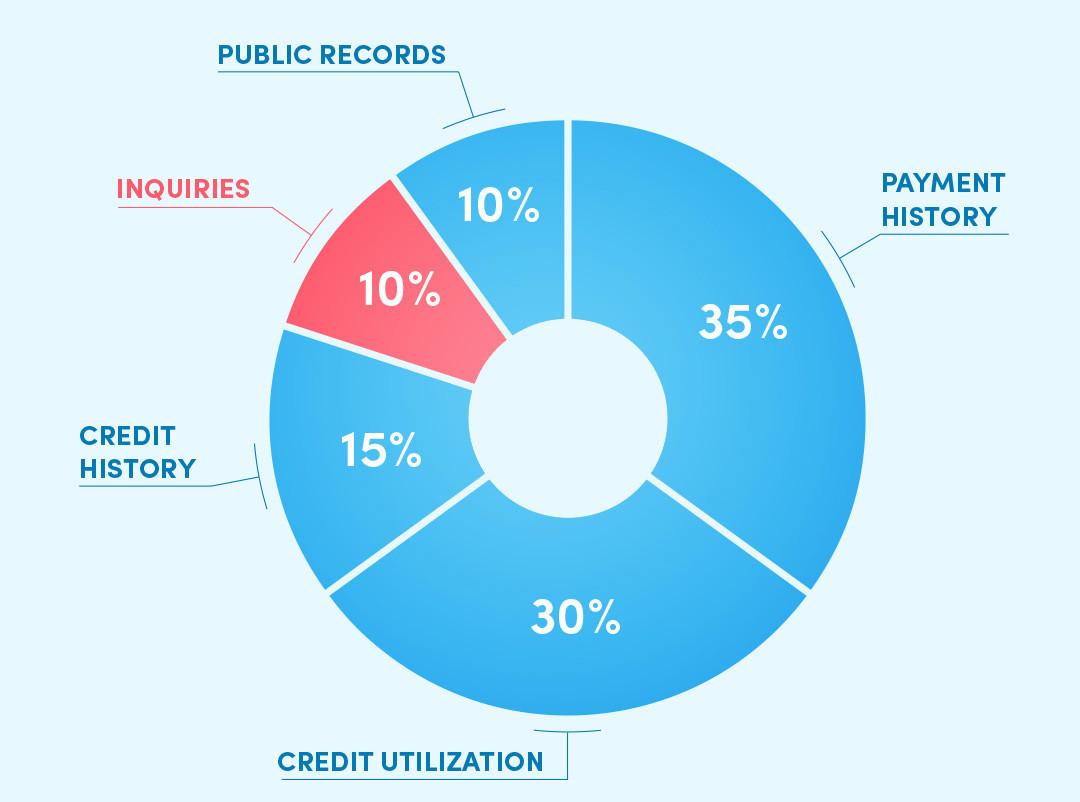

Equifax and TransUnion use proprietary formulas to calculate your credit score. Your score is a number between 300 and 900, based on a handful of factors that represent your creditworthiness. New credit applications make up 10% of the calculation.

However, banks also have their own criteria to evaluate whether to lend to you. It’s better to think of your credit score as more of a guideline that’s visible to you, and not as a perfect representation of how the bank sees you or which cards you’ll be approved for.

Generally speaking, it’s good to keep your scores above 700, preferably higher. I personally target 750, and haven’t seen a significant difference in terms of credit approval at higher…

Click Here to Read the Full Original Article at Prince of Travel…