To understand the forces that have been roiling the biggest media companies, look no further than Disney’s earnings. Streaming economics are improving — considerably so. But not fast enough to offset declines in traditional television, which is in free fall.

Disney said on Wednesday that losses in its streaming business for the most recent quarter totaled $659 million, an improvement from a year earlier (and a vast improvement from the October-to-December period, when losses totaled $1.1 billion). Streaming revenue climbed 12 percent, reflecting a sharp increase in revenue per paid Disney+ subscriber, a metric investors watch closely.

The problem: Disney still relies on old-line TV channels for a colossal portion of its profit — and those outlets are being maimed by cord-cutting, sports programming costs and advertiser pullback. Disney’s linear networks (ESPN, Disney Channel, ABC, National Geographic, FX) reported $1.8 billion in operating income, down 35 percent from a year earlier. Revenue fell 7 percent.

Unlike most of its competitors, Disney has a safety net in the form of theme parks. Operating profit in the company’s Parks, Experiences and Products division climbed 22 percent, to $2.2 billion, as Disney resorts in Shanghai and Hong Kong finally began to recover from the pandemic. Disneyland Paris continued its attendance surge, which started last summer with the opening of a Marvel-themed expansion.

Attendance also increased at Disney World in Florida and Disneyland in California, although higher costs — the introduction of a new “Tron”-themed roller coaster, for instance — dented profitability in Florida. Disney Cruise Line bookings were strong, in part because of a recent expansion of its fleet, the company said.

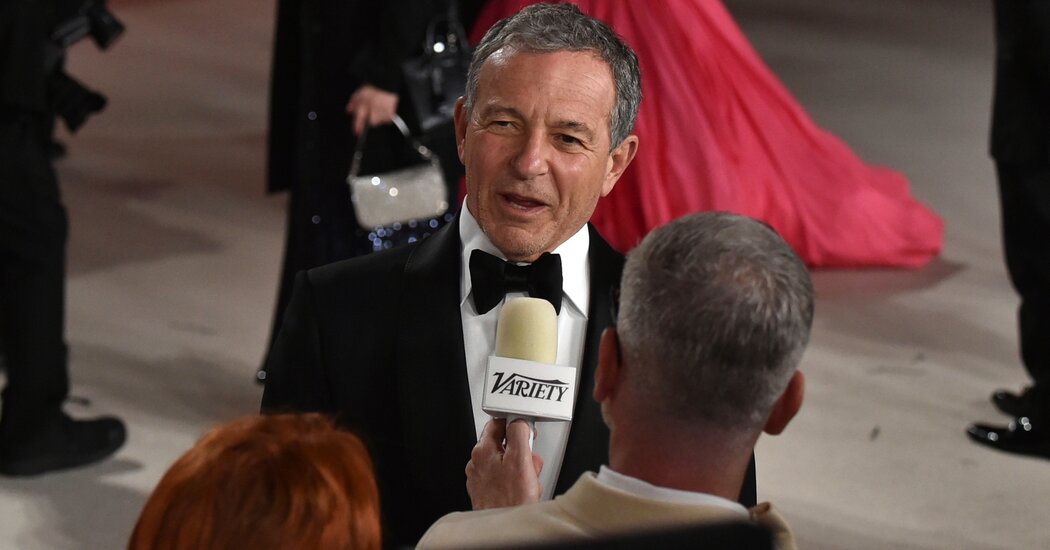

It was Disney’s first full quarter under the second reign of Robert A. Iger, who returned as the chief executive in November. He replaced Bob Chapek, who was ousted by the board following a series of blunders, including the company’s response to contentious education legislation in Florida. The fallout from that matter has led to a legal battle with Gov. Ron DeSantis over Disney World’s future expansion and oversight.

As a whole, Disney generated $21.8 billion in sales, a 13 percent increase compared with last year, slightly surpassing analyst projections. Disney reported earnings per share of 93 cents, excluding certain items affecting comparisons, on par with analyst expectations.

After a period when investors pushed…

Click Here to Read the Full Original Article at NYT > Travel…