Today, Tim Hortons announced the upcoming launch of the Tims Credit Card, a new Mastercard product powered by Neo Financial. The card isn’t available for consumers yet, but there is currently an option to put your name on a waitlist for when it officially launches.

The new credit card exclusively earns Tims Rewards points, which can be redeemed for items at Tim Hortons restaurants.

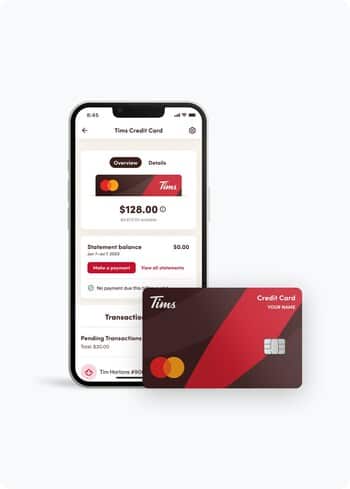

The New Tims Credit Card

Today, Tim Hortons announced details of the upcoming debut of the Tims Credit Card, a product from Tims Financial which is powered by Neo Financial. There is currently a waitlist available for the card, which will become available to consumers in the coming months.

The Tims Credit Card, which is a Mastercard product, comes with no annual fee, and exclusively earns Tims Rewards points which can be redeemed for donuts, coffee, and other items at Tim Hortons restaurants.

The earning rates for the Tim Hortons Card are as follows:

- Earn up to 15 Tims Rewards points per dollar spent at Tim Hortons restaurants

- Earn up to 5 Tim Rewards points per dollar spent on groceries, gas, and public transit

- Earn 1 Tims Rewards point per $2 spent elsewhere

It’s worth noting that Costco and Walmart are excluded from the 5x category earning bonus, and purchases made at either location will earn the base rate of 1 point per $2 spent.

The card can be applied for, approved, and managed entirely through the Tim Hortons app on your smartphone.

For Canadians with limited to no credit history, including students and newcomers, there will be a separate, secured version of the Tims Credit Card to help with building credit. The card comes with different earning rates, which are as follows:

- Earn up to 14 Tims Rewards points per dollar spent at Tim Hortons restaurants

- Earn up to 2 Tims Rewards points per dollar spent on gas, groceries, and transit

- Earn 1 Tims Rewards point per $4 spent elsewhere

Both the secured and unsecured versions of the Tims Credit Card come with the following insurance coverage:

- Extended warranty of up to one extra year

- Purchase protection

- Mastercard Zero Liability, which offers protection against unauthorized transactions on your card

Anyone interested in applying for the card can add their name to a waitlist on the Tims Financial website. Once the product becomes available, they will be notified.

Is the Tims Credit Card a Good Deal?

The Tims Credit Card offers category spending…

Click Here to Read the Full Original Article at Prince of Travel…