Posted: 7/31/23 | July 31st, 2023

Travel insurance isn’t an exciting topic to research. When you’re planning a trip, the last thing you want to do is compare policies about theft and injuries that can occur abroad.

But, as I’ve said before, when an emergency strikes, it’s better to be safe than sorry.

Whether you’re traveling for two weeks or two months, buying travel insurance is a must.

But what happens when you’re gone for two years, not just two months?

In that case, you need more than just emergency coverage. You need health care. You need coverage for routine and preventive check-ups and prescription drugs, as well as for broken limbs and lost luggage.

Created by SafetyWing, Nomad Health is global health insurance coverage for remote workers, expats, and nomads.

It’s both emergency travel insurance and medical insurance while you’re away. It’s super affordable, making it a game changer for long-term travelers, digital nomads, and those living abroad.

Here’s everything you need to know about Nomad Health to decide if it’s right for you and your travel plans.

What is Nomad Health?

Nomad Health is insurance for digital nomads, remote workers, and long-term travelers. It’s a mix of your standard emergency coverage that all travel insurance plans offer, along with “regular” health care coverage, such as routine visits and preventive care.

It’s a replica of the kind of health insurance you might find in your home country, ensuring that you’re looked after no matter what happens.

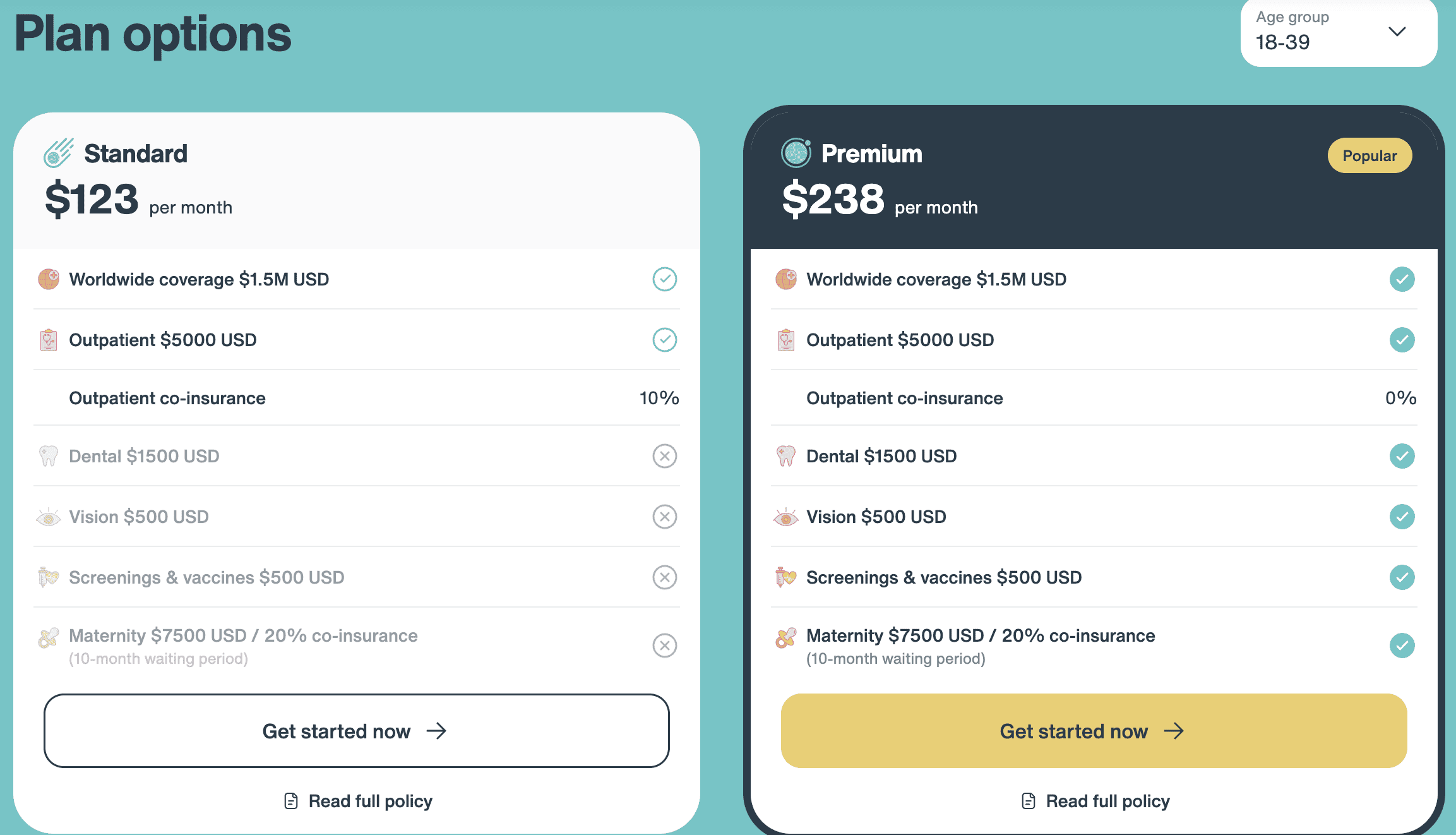

Currently, there are two tiers: Standard and Premium. The main differences (as you can see in the image below) is that Premium offers greater coverage: dental up to $1,500 USD, vision up to $500 USD, vaccines up to $500 USD, and maternity costs up to $7,500 USD.

You can learn more and compare the plans here.

How is Nomad Health Different from Regular SafetyWing Coverage?

Travel insurance should be thought of as “emergency insurance.” If you break a leg or lose a bag or get stuck in a hurricane, travel insurance can help.

Nomad Health, however, covers both emergencies and regular medical care. That means you can get support — and get reimbursed — for emergency and non-emergency events.

There are a few other differences to note when comparing Nomad Health with SafetyWing’s standard travel insurance (called Nomad Insurance):

- Nomad Heath covers those up to age 74 (vs. 69 for Nomad Insurance)

- There is no deductible…

Click Here to Read the Full Original Article at Nomadic Matt's Travel Site…