As 2023 heads into its final approach, it’s time to look back at some of the stories that shaped Miles & Points in 2023, and forward to what we might encounter in 2024.

For reasons of parsimony, I’ll keep the discussion here focused on the Canadian context, referencing US and global programs when appropriate.

Canadian Credit Cards in 2024

This year, we saw some great promotions being offered by Canadian credit card issuers to lure new cardholders to their products.

In some cases, this took the form of a record-high welcome bonus, while in others, new features were added (sometimes paired with an increased annual fee).

As per usual, American Express gives its cardholders the most reasons to apply for and hold onto their products: Amex Membership Rewards points have the most partners to transfer to, the cards have the most competitive earning rates, Amex Offers provide great ongoing value, and referral bonuses encourage cardholders to spread the good word.

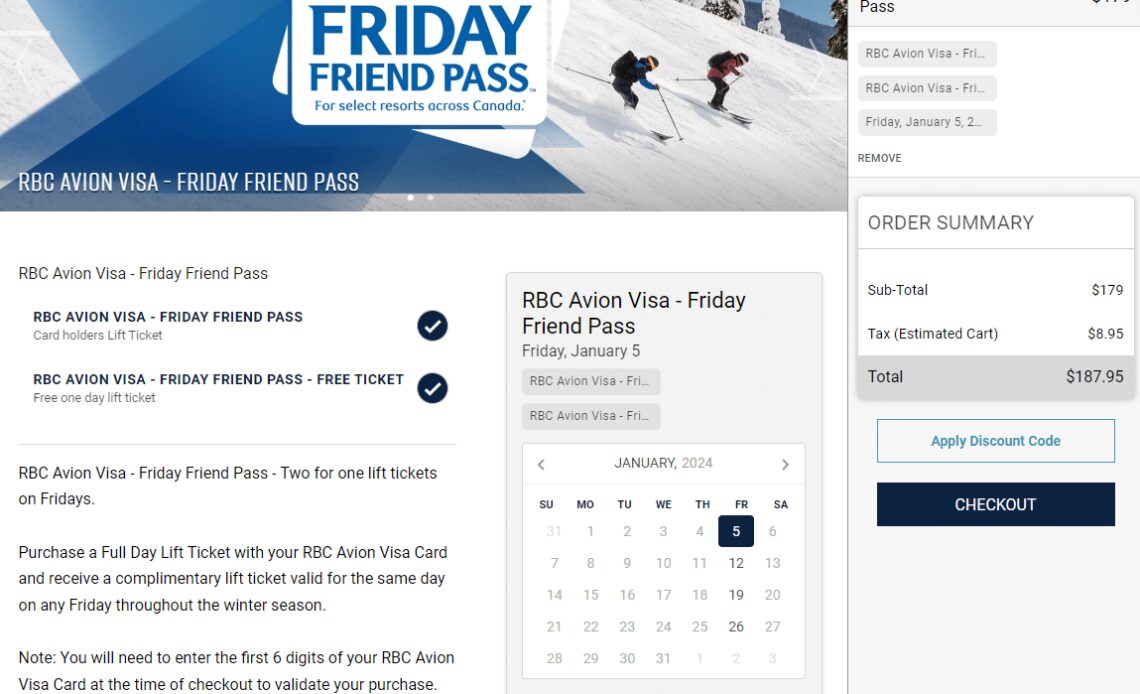

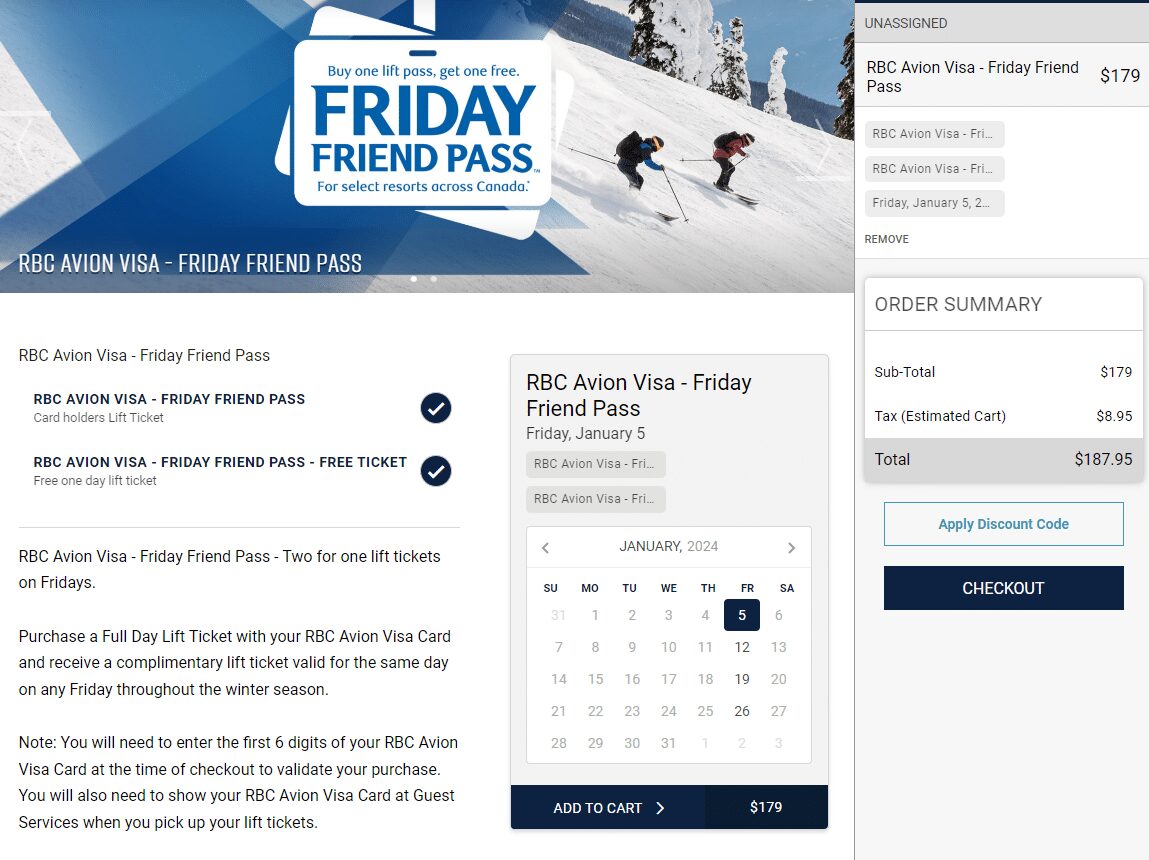

However, it’s been encouraging to see RBC expand its own suite of “RBC Offers” in 2023, as well as bringing back the Friday Friend Pass for free lift passes at ski resorts throughout Canada. Perks such as these can provide excellent value to cardholders, and hopefully we’ll see RBC expand on its offerings, as well as other issuers take note and launch similar perks in 2024.

Another common theme we’re seeing is welcome bonuses requiring spending throughout the year, and even into the second year, to unlock the full allotment of points. It’s no surprise that banks want to see cardholders use their products for more than just the welcome bonus, and structuring offers this way forces our hands accordingly.

A great example of this was the structure of the first-ever welcome bonus in the form of points on the Air France KLM World Elite Mastercard, which has now expired. New cardholders received 10,000 miles upon making a purchase, another 10,000 upon spending $5,000, another 10,000 upon spending a further $10,000, and then 30,000 miles upon renewing the card for a second year.

This is also true with many cards now having smaller monthly spending requirements, rather than a single threshold to unlock a swath of points after three months or so.

On the other hand, a shining example of a card that doesn’t encourage its holders to keep it for the long-term or to use it for daily spending was the launch of the Cathay World…

Click Here to Read the Full Original Article at Prince of Travel…