Miles & Points are a powerful tool that can unlock luxury travel at a fraction of the cost; however, there’s a lot to learn before you can begin flying business class all around the world.

Even though it may seem “too good to be true”, you can actually travel in luxury without having to spend thousands – it just takes some effort. After all, “free” business class flights don’t just fall out of the sky.

In this Miles & Points for Beginners series, our goal is to guide you through the world of Miles & Points and help you get over the steep learning curve.

With a bit of effort, in no time at all, you’ll be able to earn enough points to cover even the most aspirational trips.

To begin, let’s dive into the backbone of it all: What are Miles & Points, and why do they matter?

What Are Miles & Points?

Miles and points are currencies made up by airlines, hotels, and banks. Similar to real currencies, you can use accumulated miles and points to make purchases.

The most common ways to earn miles and points are through spending on credit cards, and through engaging with loyalty programs.

You earn points through welcome bonuses and with each purchase you make with your credit card, and you also earn points on paid flights with airlines and through hotel stays, amongst other means.

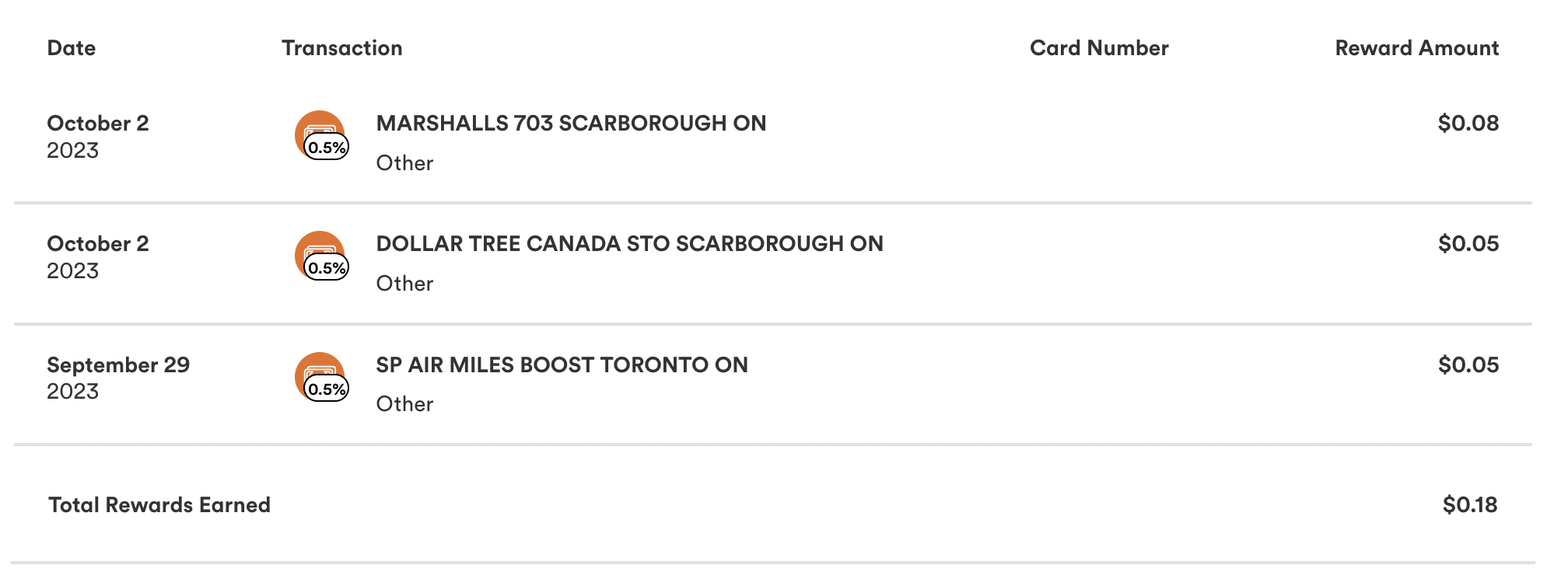

Credit card rewards come in many forms. In fact, there are four different types of rewards:

- Cash back

- Fixed-value points

- Loyalty-program points

- Transferable points

Each of the four types of credit card rewards have their place, and can be useful as part of an overall travel strategy.

That said, if you want to earn credit card rewards to travel in luxury, there are certain types you’ll want to focus on more than others.

Different Kinds of Rewards: Cash Back

Every bank offers some form of cash back credit card. With a cash back card, you simply earn a set amount of money for every dollar you spend.

The cash back return on spending always has 1:1 value. This means that if you earn 1% in cash back rewards, you’ll get $1 (all figures in CAD) back for every $100 you charge to your credit card – no more, no less.

Some credit cards offer higher cash back rewards on specific categories. For example, the Scotiabank Momentum® Visa Infinite* Card comes with the following cash back earning rates:

- 4% cash back on groceries and recurring payments

- 2% cash back on gas and transit

- 1% cash back on all other…

Click Here to Read the Full Original Article at Prince of Travel…