TD Rewards is the in-house points currency offered exclusively by TD Bank. The rewards program allows TD Rewards credit card holders to earn TD Rewards Points.

The rewards program is available through three of TD’s personal credit cards: the TD Rewards Visa* Card, the TD Platinum Travel Visa* Card, and the TD First Class Travel® Visa Infinite* Card.

In this guide, we’ll go over how to access this program with a personal TD credit card, and how to earn and redeem TD Rewards Points for excellent value.

What Is TD Rewards?

TD Rewards is TD Bank’s in-house points currency that’s accessible through three personal credit cards and one business TD Rewards credit card.

Credit cards in the TD Rewards program earn TD Rewards Points, which are a fixed-value points currency that’s exclusive to the bank.

The fact that the currency has fixed value means that the value of the points doesn’t fluctuate, and instead its value is based on the way in which you choose to redeem them (more on this below).

TD Rewards Points can be earned exclusively through credit card welcome bonuses that you can access as a first-time cardholder when you get a TD Rewards credit card, and through spending on the same eligible card.

As you earn a welcome bonus and additional points through day-to-day spending, your TD Rewards account balance will grow.

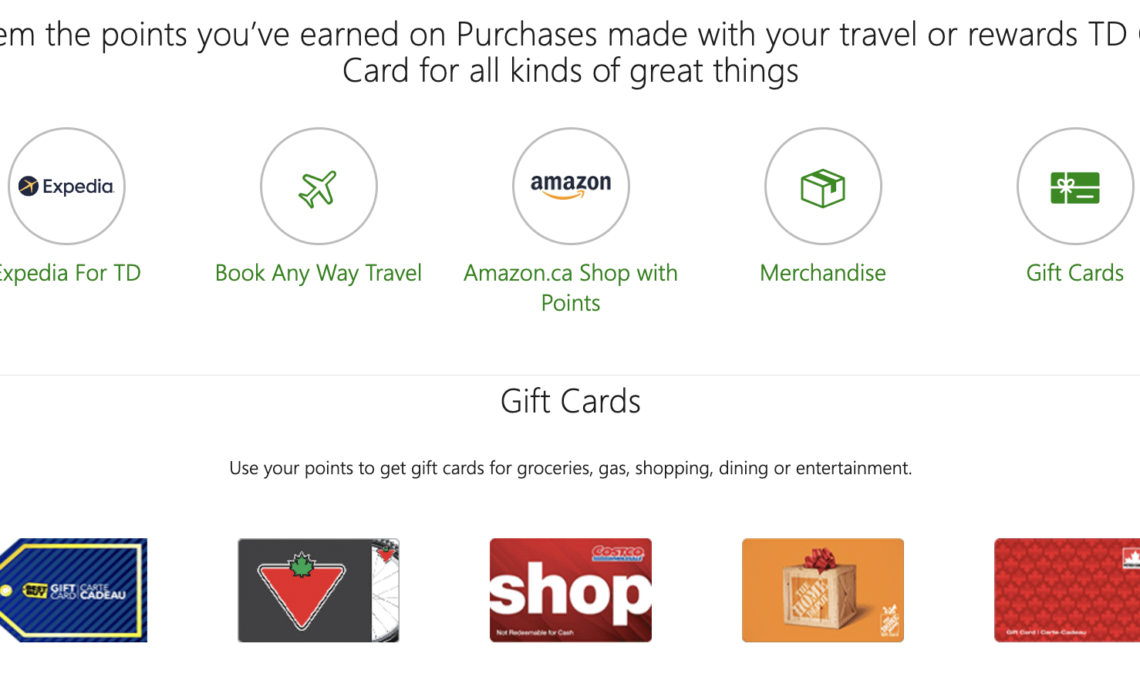

These accumulated points can be redeemed several ways, with the fixed value of a single TD Rewards Point ranging from 0.25 cents per point to 0.5 cents per point (all figures in CAD).

This means that if you had 100,000 TD Rewards Points in your account, you could redeem these for a value of between $250 and $500, depending on which type of redemption you choose.

The most valuable way to redeem TD Rewards Points is for travel, which we’ll explore in detail below.

TD Rewards Points are a great points currency to collect if you’re someone who wants to be able to redeem points for travel, and especially if you often book your trips through Expedia.

TD Rewards Points are also a great currency to collect in addition to other airline and hotel points, since they’re useful in offsetting other travel costs, such as cruises, independent hotels, and short-term rentals that aren’t covered by brand-specific programs (e.g., Aeroplan, Marriott Bonvoy, WestJet Rewards).

Since TD Rewards Points are redeemable at a fixed value that’s tied to the cash value of the…

Click Here to Read the Full Original Article at Prince of Travel…