When it comes to understanding the ins and outs of personal finance, there can often be a steep learning curve. Between budgeting, debt management, and planning for the future, the whole subject can be quite overwhelming.

Credit scores are often a source of financial concern, and it’s not uncommon to be unsure about what your credit score means and why it changes, or even what your score is.

To help you improve your knowledge around this aspect of your finances, this article will go over the basics about credit scores in Canada, including what they are, how they’re used, how to check yours, and how you might improve your credit score over time.

Credit Score Basics

In Canada, a credit score is a three-digit number that is designed to represent how likely it is that you’ll pay your bills on time (i.e., your credit risk). Your credit score is calculated based on information in your credit report, which we’ll talk about below.

Building a good credit score is important as it helps lenders determine your capacity to acquire and maintain credit, and this, in turn, helps you get approved for personal loans, mortgages, and of course, credit cards.

The better your credit score, the more lending options will be available to you and the more access you’ll have to competitive interest rates.

Canada has two main credit bureaus, Equifax and TransUnion, that calculate and provide credit scores. These two companies assess information from banks, credit card issuers, collection agencies, and more to track how you use your credit and to determine your overall credit score.

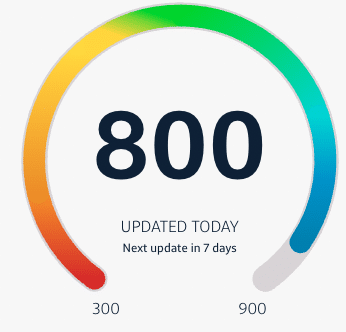

A credit score typically ranges from 300 to 900 and is categorized as Poor, Fair, Good, Very Good, and Excellent.

The ranges used to determine which of these categories you fall within change depending on which credit bureau’s model you use, but according to Equifax, the category ranges break down as follows:

- Excellent: 760–900

- Very Good: 725–759

- Good: 660–724

- Fair: 560–659

- Poor: 300–559

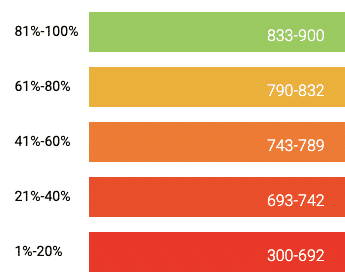

TransUnion uses a bit of a different approach, in that the scores are broken down into 20% bands, each representing the proportion of Canadians with a score in that range.

- 81–100%: 833–900 (Excellent)

- 61–80%: 790–832 (Very Good)

- 41–60%: 743–789 (Good)

- 21–40%: 693–742 (Fair)

- 1–20%: 300–692 (Poor)

You can think of each 20% block as Excellent, Very Good, Good, Fair, and Poor, although it’s not the…

Click Here to Read the Full Original Article at Prince of Travel…