Lost luggage…interrupted travel plans…cancelled trips…medical emergencies, these travel mishaps happen and can be a travel nightmare if you haven’t prepared ahead. That’s where travel insurance comes into play.

I hear people talk about travel insurance nightmares where they are given the run around trying to get an insurance policy to pay out. These stories tend to be tales of woe where too much time was expended getting their claim rightfully paid out. Chasing around a claim can be like a bad dream, but the real nightmare comes from the stories—all too frequently—that I hear from people who didn’t have travel insurance.

Without travel insurance all the money you expended on your vacation could be lost if the trip was cancelled or interrupted by unforeseen circumstances. If your bags are lost, you could be out a lot of money. Or if they’re delayed, you would have to buy products/clothing to get you through until the luggage is delivered (we had this happen once and it took five days for our bag to arrive). If you had a medical or dental emergency, you might find yourself with a huge bill. With travel insurance, potential nightmares would just be a momentary bad dream.

Travel insurance is not a one-size-fits-all product, so you want to compare policies to make sure you’re buying a policy that best aligns with your needs. Some of the potential benefits you could find in a travel insurance policy are:

- Trip Cancellation/Interruption Coverage

- Travel Delay Coverage/Missed Connection Coverage/Airline Ticket Change Coverage

- Cancel for Any Reason Travel Insurance

- Emergency Medical/Dental Insurance/Medical Evacuation Coverage

- Lost or Delayed Baggage Coverage

- Accidental Death and Dismemberment/Repatriation of Remains

- Auto Rental Coverage or Short-Term Rental Coverage

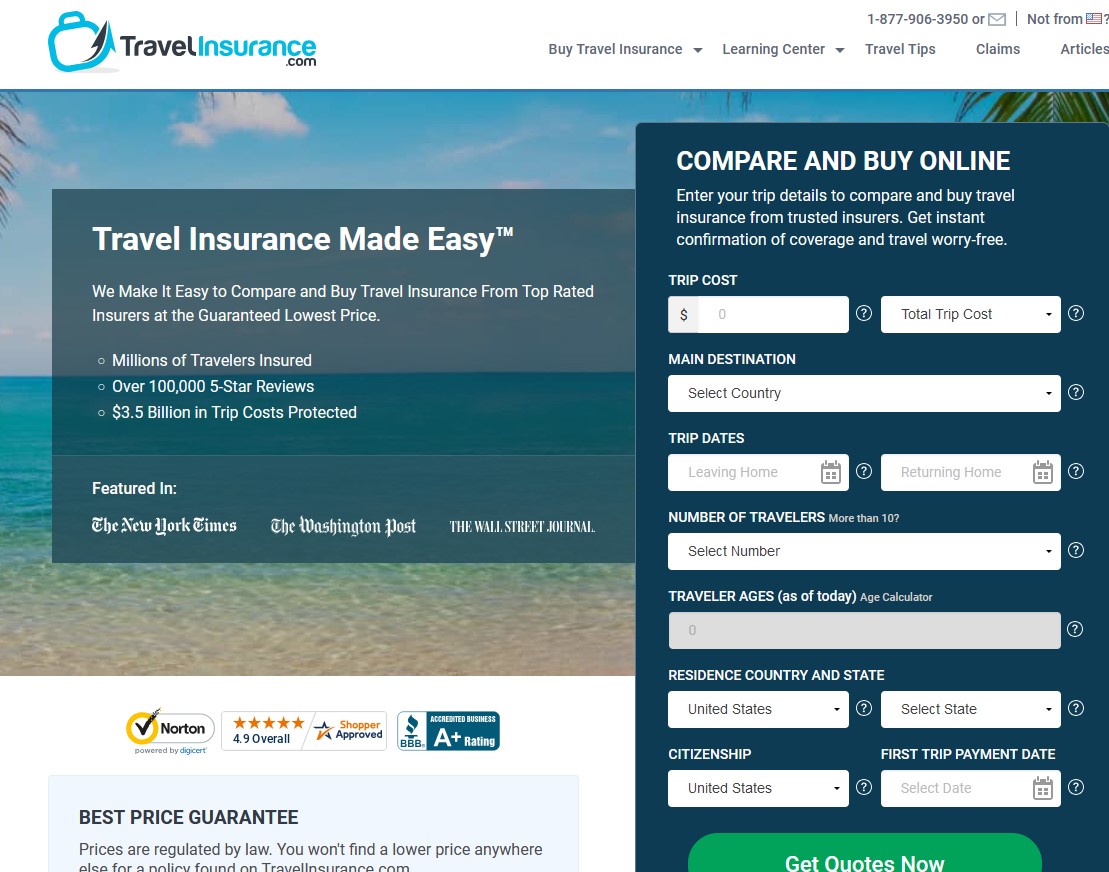

Although I have some travel insurance benefits covered by my credit card, I usually buy an independent policy for each trip since my credit card doesn’t provide all the coverage I need and doesn’t have the coverage amounts I want for some things. I generally use Travel Insurance dot Com for my travel insurance needs.

The website is very easy to use—you just plug in your travel details (age, area of residence, area of travel, expected dates, first trip payment date, and estimated trip cost) and Travel Insurance dot Com will search policies for you. At your fingertips are the basics for each policies. You can see what type of coverage…

Click Here to Read the Full Original Article at Roaming Historian…