The Scotiabank Gold American Express® Card has seemingly been flying under the radar of Miles & Points enthusiasts. This is not too surprising given that the card is tethered to the Scene+ program, which likewise doesn’t get quite as much love as airline and hotel loyalty programs like Aeroplan and Marriott Bonvoy.

However, the Scotiabank Gold American Express® Card has a slew of great benefits that shouldn’t be overlooked – from its 5-6x earning multiplier at grocery stores and restaurants to its no foreign transaction fee feature, and more.

In this review, we’ll take a deep dive into this underrated card.

What we love: no foreign transaction fees, great domestic earning rates, flexible Scene+ points

What we’d change: apply earning rates to foreign purchases, make Scene+ points transferable

Low Income Requirement and Affordable Annual Fee

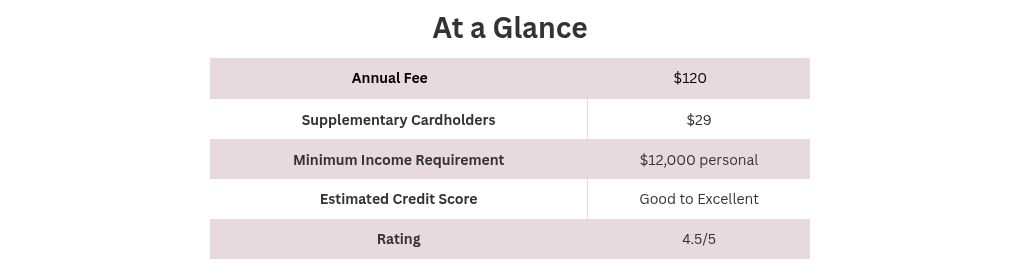

One of the standout features of the Scotiabank Gold American Express® Card is its low minimum income requirement of just $12,000 per year, which is significantly lower than the $60,000–$80,000 typically required for Visa Infinite or World Elite Mastercard products.

This makes the card accessible to students, newcomers to Canada, or anyone starting out in an entry-level or part-time job.

The $120 annual fee is also more affordable than most premium rewards cards in its class, many of which charge $139 or more. Better yet, the fee is often rebated in the first year as part of the welcome offer, lowering the barrier to entry even further.

Consistent Welcome Bonus

The welcome bonus of the Scotiabank Gold American Express® Card consistently ranges from 40,000–50,000 Scene+ points, which is worth up to $400–500 (all figures in CAD). The all-time high offer on the card was for 50,000 Scene+ points, and is currently available.

Generally speaking, at least part of the welcome bonus on Scotiabank’s suite of Scene+ cards has an easy-to-achieve minimum spending requirement, including on the Scotiabank Gold American Express® Card.

The second half of the bonus is somewhat more difficult to earn; however, the good thing is that you usually have a full year to fulfill the requirement, which you can stagger as needed or fulfill it all when you have trips abroad. After all, as we’ll discuss below, this card doesn’t levy foreign transaction fees.

Click Here to Read the Full Original Article at Prince of Travel…