Over the years, Scene+ has evolved from a rewards program that gets you free cinema tickets and fast food to one of Canada’s leading players in the loyalty space.

This evolution of the program has made Scotiabank’s suite of credit cards, most of which are tethered to Scene+, more attractive.

In this guide, we’ll provide an overview of the various Scene+ cards being offered by Scotiabank to help you more easily navigate your options.

Scotiabank’s Suite of Scene+ Credit Cards

Scotiabank offers a wide array of credit cards, which can be classified into three main categories: travel and lifestyle, cash back, and low interest.

Within the travel and lifestyle group, you can find the following cards that all earn Scene+ points:

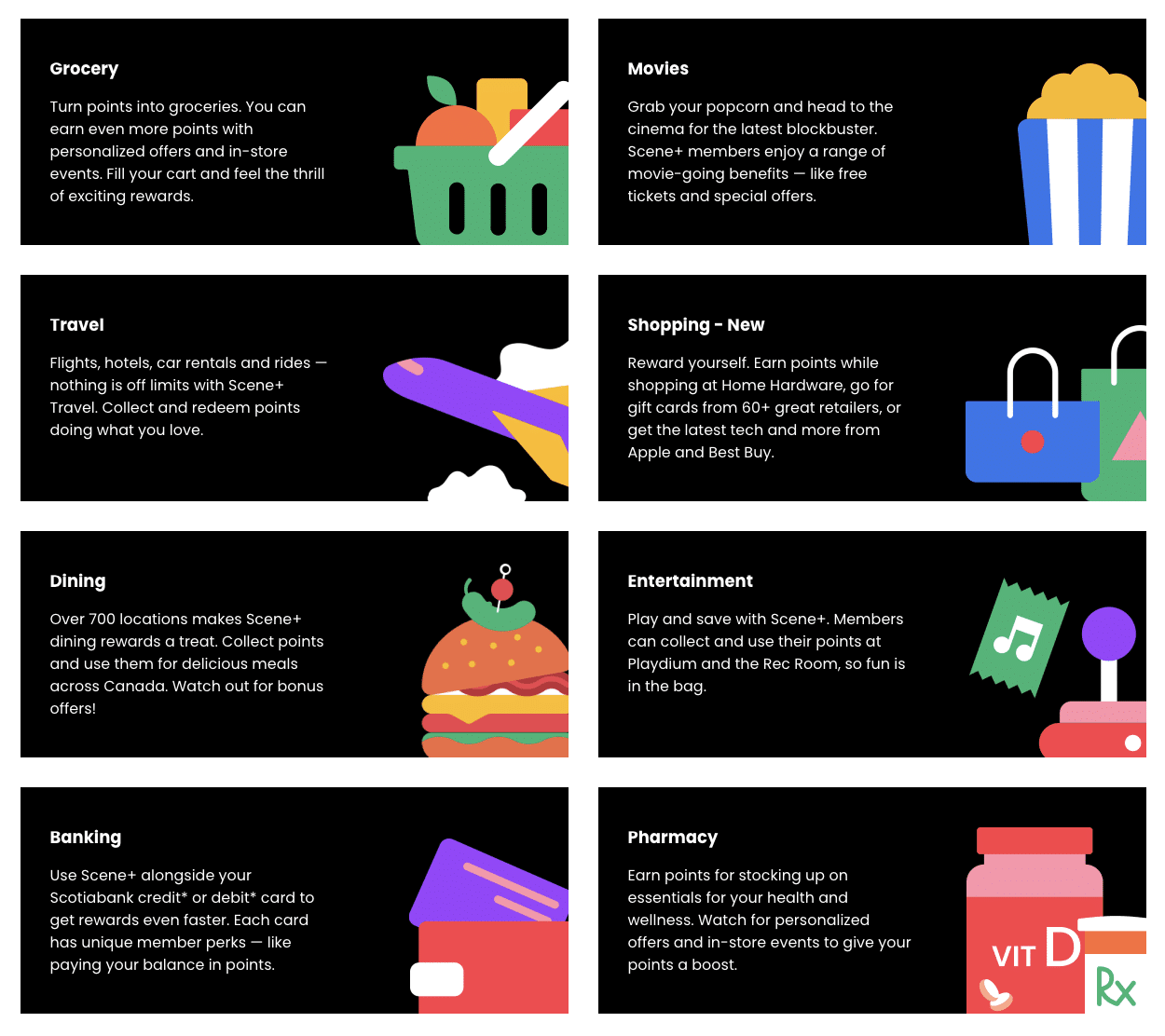

Scene+ is the loyalty program co-owned by Scotiabank, Cineplex, and the Empire Company, which is behind grocery chains like Sobeys, Safeway, Freshco, and others.

Over the years, the Scene+ program has grown thanks to recent partnerships with the Empire Company, Rakuten, Expedia, and Home Hardware.

This revitalization of the program has made Scene+ points more valuable and useful than ever before, and has also made Scotiabank Scene+ cards all the more appealing for everyone – from travellers, to those who are looking to save money on their groceries and nights out.

We’ve written a complete guide to the Scene+ program, so if you’d like to learn more about how to turn your Scene+ points into free hotels, flights, or piles of groceries, we recommend you take a look.

With this bit of background information in mind, let’s explore the different Scotiabank Scene+ cards below.

Scotiabank Gold American Express® Card

The flagship American Express product by Scotiabank, the Scotiabank Gold American Express® Card has two standout features: great domestic earning rates and no foreign transaction fees.

The fees and eligibility requirements for this card are as follows:

- Annual fee: $120 (all figures in CAD)

- Supplementary cardholders: $29

- Minimum income requirement: $12,000 (personal)

- Estimated credit score needed: Good to Excellent

That $12,000 income requirement is surprisingly low for a card in this tier. Most competitors in the same ballpark ask for $60,000+ in personal income. So if you’re a student, newcomer to Canada, or rocking a part-time gig while building credit, this is one of…

Click Here to Read the Full Original Article at Prince of Travel…