Posted: 11/7/22 | November 7th, 2022

As an avid travel hacker, I’m always looking for new ways to earn more points and miles through my everyday spending. As a result, I earn over one million points every year, allowing me to enjoy all kinds of free flights and hotel stays, upgrades, lounge access, elite status, and more.

Travel hacking has saved me thousands and thousands of dollars over the years, and I wouldn’t be able to travel as much without it.

However, there’s traditionally been one huge expense that has always been hard to earn points for: rent.

For years, travel hackers have taken advantage of temporary offers that waive credit card fees or gone through complex procedures to pay their rent so they could get points.

But these maneuvers were all hit or miss and never lasted long. Thousands of potential points continued to be left on the table.

Until now.

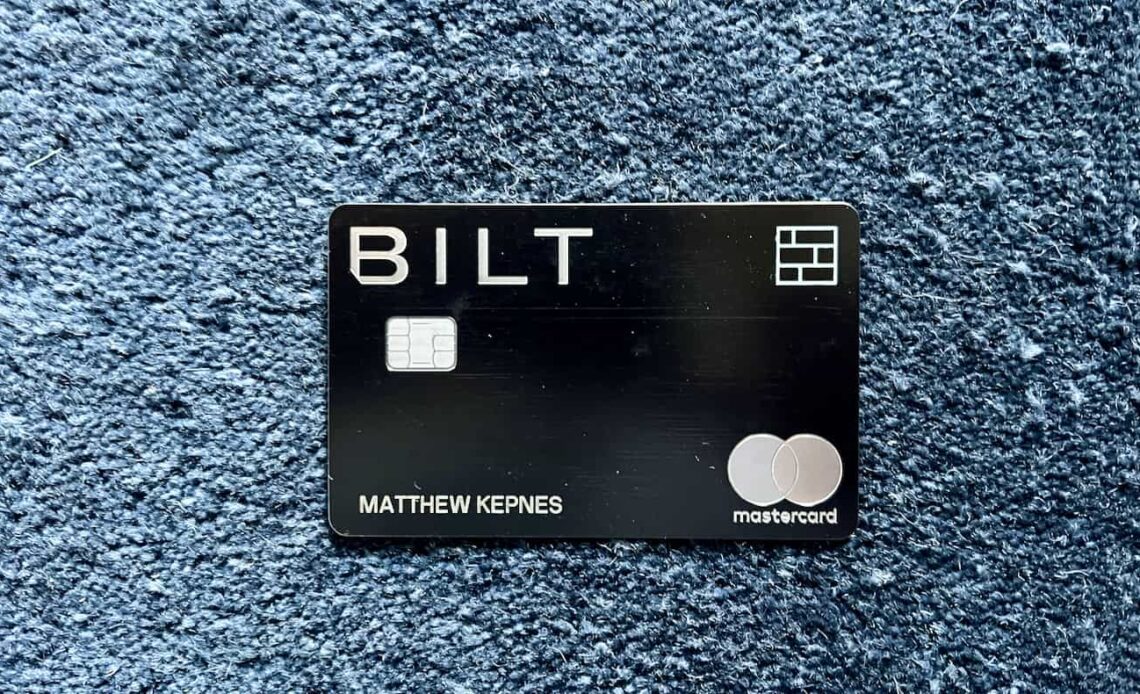

Earlier this year, a card called Bilt came out. And it has changed the game.

What is Bilt?

Bilt is a credit card that allows you to earn points when you pay your rent (as well as on everyday purchases). You then use those points like you would any other rewards program: you can use them to book travel directly, you can transfer them to travel partners, or you can use some of the other redemption options.

There are two ways to earn points with the card: by renting a Bilt Alliance property, or by using the Bilt World Elite Mastercard®.

Bilt Alliance properties form a network of two million units across the US. But I’m not going to focus on that. I’m going to talk about its credit card.

How does the Bilt reward card work?

Once you open a Bilt Mastercard® (which is issued by Wells Fargo and has no annual fee), you go to the Bilt app or website to set up your recurring monthly rental payments.

Bilt then creates a unique bank account tied to your Bilt credit card so that your rent is paid with an e-check rather than through your credit card. This bank account is basically a legal “dummy” account created as a workaround for credit card processing fees. You do not use it for anything else, and you do not withdraw or deposit money from it.

Whenever these unique routing and account numbers are used to pay rent, your Bilt Mastercard® is charged for the same amount. (You still have to connect your personal bank account to pay off the card each month.)

And, if your property is old-school and only accepts checks, you can still pay with your Bilt card through the Bilt Rewards app,…

Click Here to Read the Full Original Article at Nomadic Matt's Travel Site…