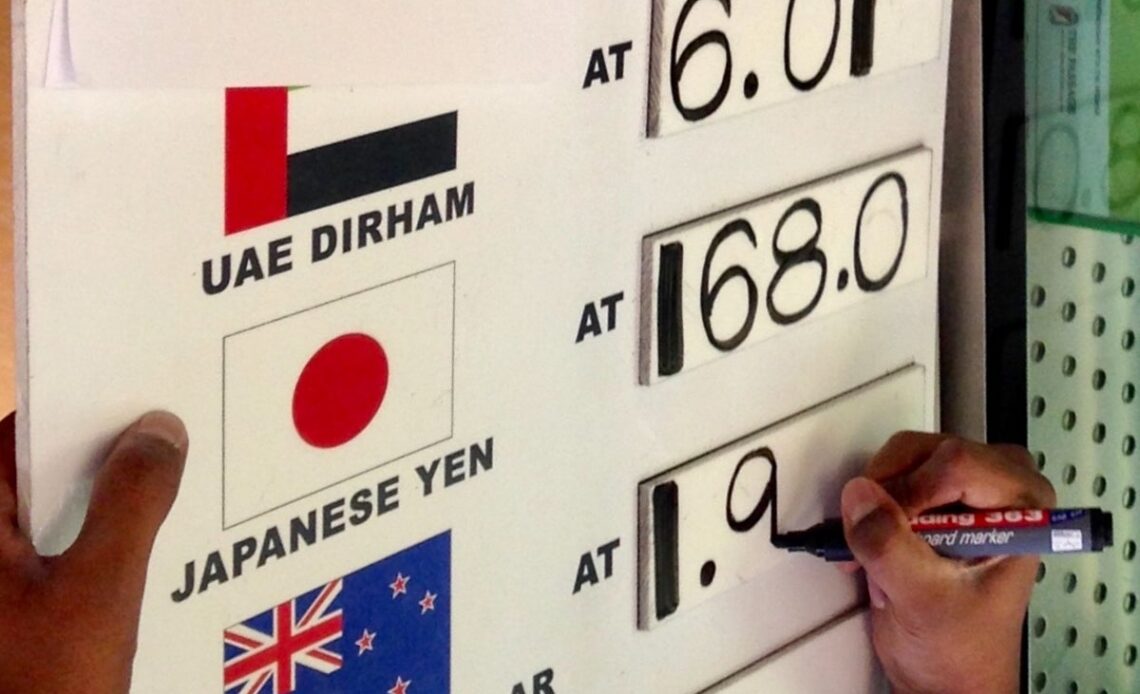

At sterling’s 21st-century peak in 2008, £1 was worth over US$2 on the foreign exchanges. During the calamitous premiership of Liz Truss, the pound sank almost to parity against the American dollar in October 2022. The UK currency has recovered slightly, but is still only worth $1.22 or so. Sterling’s fall is mirrored against other currencies that are locked to the US$, including UAE dirhams and the dollars used in many Caribbean islands.

Shortly after the euro was introduced at the start of 2002, sterling was riding high: worth €1.65. Today it has shed about 50 euro cents to around €1.15. Against the Swiss franc, the pound has fared even worse – losing half its value in 15 years, corresponding to a doubling of prices for British travellers.

Given the continued erosion in the value of the pound, it is essential to avoid further losses by managing your holiday finances well.

If you leave holiday money to the last moment and change money at the airport on your way out, you will be wasting your cash – which would be much better spent at your destination. In addition, the pandemic accelerated changes in how travellers transact, with contactless payment increasingly the norm.

These are the key questions and answers on holiday money.

Using a credit or debit card

This is a fast and easy method of paying your way, whether with a physical card or a card on a phone. We are now in an age when cards are used for the most minor transactions. Crucially, though, you could be losing a slice of cash every time you use your normal UK bank card abroad.

For most mainstream UK credit and debit cards, banks charge just under 3 per cent (usually 2.95 or 2.99 per cent) as a “foreign currency transaction fee”. Adding almost £3 to a £100 purchase represents free money for them at your expense.

Some also impose an additional “cash advance fee” – sometimes a flat £1.50 or a percentage of up to 5 per cent – for withdrawals from an ATM.

Check your card provider’s policy – which should be easily visible online – and if necessary get a new card specifically for overseas use.

How can I dodge the card fees?

If you are a First Direct customer, your Mastercard debit card is fee-free abroad. For other travellers who seek a simple solution, apply for a Halifax Clarity credit card and use it purely for spending overseas; it does not add…

Click Here to Read the Full Original Article at The Independent Travel…