Who wouldn’t want to make a living from traveling the world and writing about their experiences?

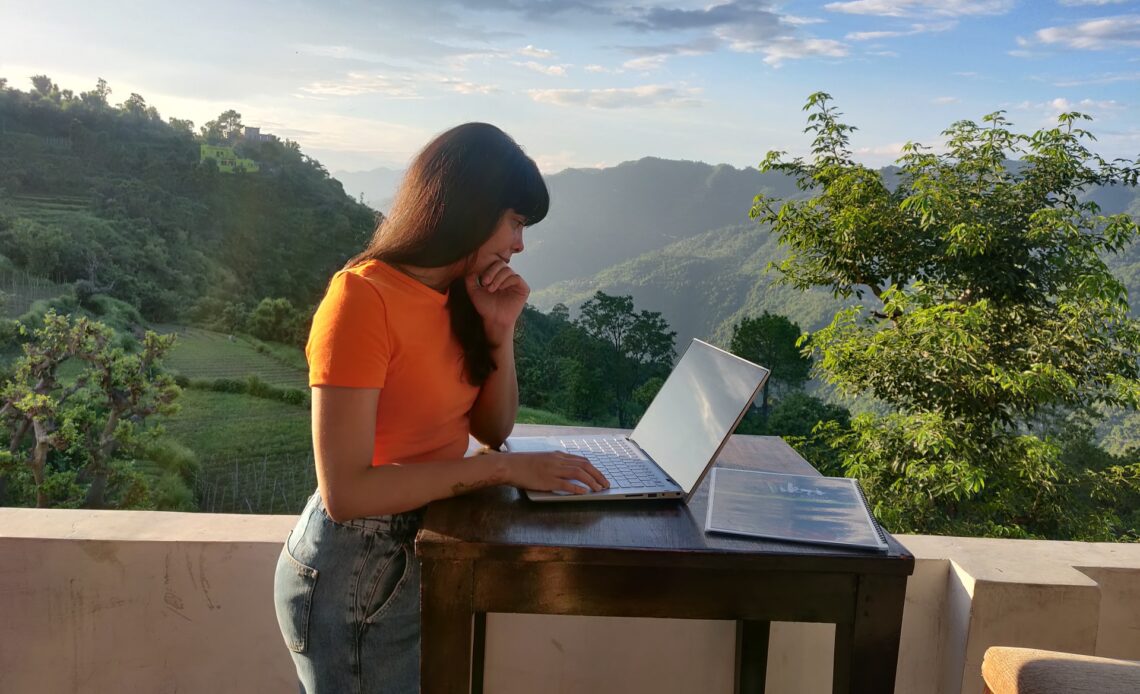

Nowadays, as long as you have a serious case of wanderlust, a laptop, and an internet connection, potentially anyone can make this dream a reality.

However, there’s more to it than this. Travel blogging may sound pretty straightforward, but there are many things you’ll need to consider before you take the plunge and set up your website.

You’ll need to consider travel-related expenses, equipment expenses, your travel writing skills, brand sponsorships, affiliate programs, and everyone’s least favorite pastime – filing taxes.

Thanks to the helpful advice in this guide, you’ll learn how to file taxes as a travel blogger and tax deductions you can take advantage of.

By learning all this information before you start blogging, you can save money and avoid getting into trouble with the IRS.

Filing Taxes as a Blogger

If you’re earning money as a blogger, even if you treat blogging as a hobby rather than a career, you need to pay taxes on this income. Failure to do so could lead to issues with the IRS.

However, filing your taxes will differ depending on whether you’re blogging as a hobby, side hustle, or full-time career. Here’s a quick explanation for each category.

Blogging as a Hobby

If you run a travel blog purely for pleasure rather than money, you could still find yourself making an income from this hobby through affiliate links and adverts. This means you must declare this income on your annual income tax return.

Since you won’t be treating your blog as a separate business, it’s relatively easy to add your income from your blog to your income tax return. You won’t have to worry about setting up a business and paying corporate tax.

Differentiating between a business and a hobby can be difficult, especially if your hobby grows into a business. If you’re unsure, check out this page on the IRS website.

Generally, if you’re keeping accurate financial records and putting effort into making your blog profitable, then your travel blog can be considered a business.

Blogging as a Side Hustle

Blogging as a side hustle means using your blog to earn extra money to supplement your primary career. Therefore, this side hustle counts as a business in its own right.

By owning a travel blog as a side hustle, you become the sole proprietor of…

Click Here to Read the Full Original Article at GoBackpacking…