Rogers Bank has announced some changes to its entry-level Rogers Connections Mastercard, which took effect as of May 17, 2023.

Under the revamp, the card will now feature a 2% across-the-board cash back for eligible Rogers subscribers, and it no longer comes with an annual fee. As part of the launch, new cardholders can earn 10% cash back on all purchases for the first three months, up to $1,000 spent.

The Revamped Rogers Connections Mastercard

The Rogers Connections Mastercard is an entry-level offering under the telecommunication giant’s banking arm, Rogers Bank. All of its credit cards are cash back-yielding products, but in contrast to the higher-level Rogers World Elite Mastercard, it has no minimum income requirement.

As a welcome bonus, its earn rates are accelerated in the first three months to 10% up to a maximum of $1,000 (CAD) in purchases. Therefore, by spending $1,000 in the first three months, you’ll have earned $100 (CAD) in cash back.

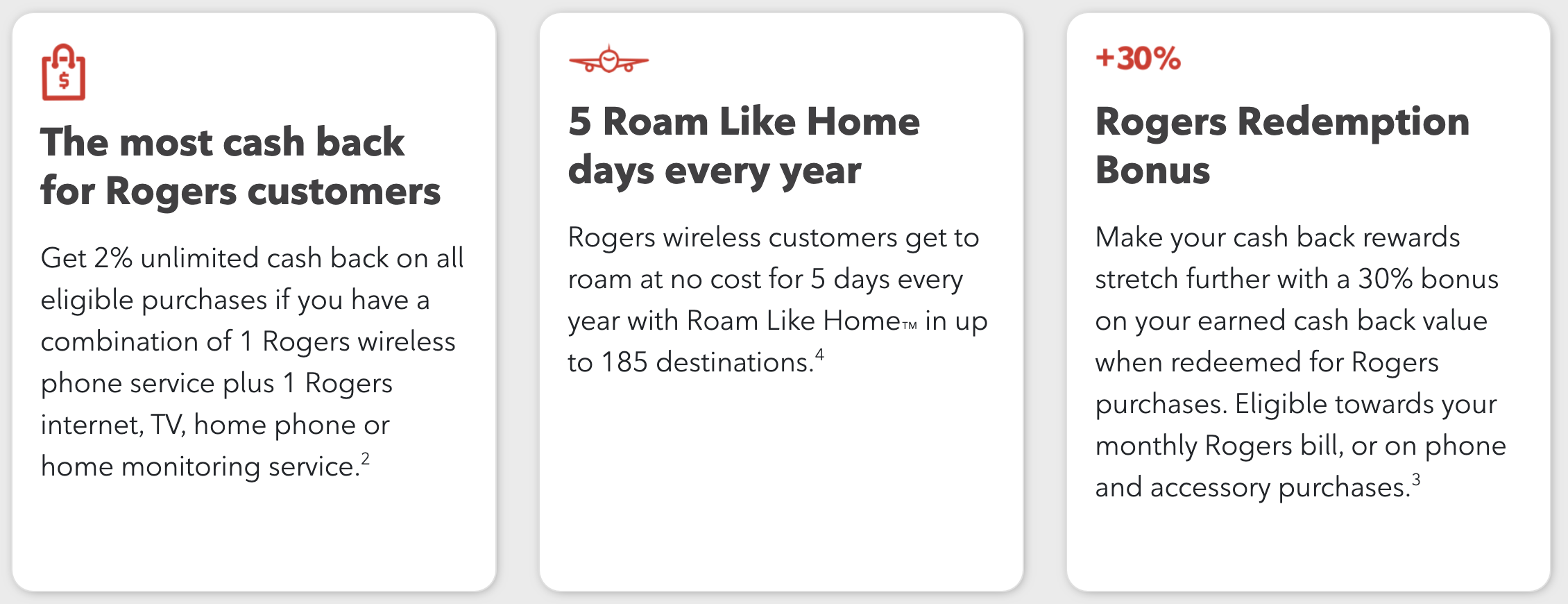

Starting today, Rogers Bank is increasing the earning rate on the Rogers Connections Mastercard to 2% cash back on all purchases for eligible subscribers of its telecommunications services.

In order to qualify for the 2% cash back base earning rate as an eligible Rogers customer, you’ll need to have a combination of at least one Rogers wireless phone service and at least one Rogers internet, TV, home phone, or home monitoring service.

In other words, you must have both a mobile phone plan and an internet, TV, home phone, or home monitoring service to be eligible.

If you don’t qualify as a Rogers customer, the regular cash back earning rates are 2% for transactions in US dollars and 1% for everything else. Keep in mind that you’ll incur a 2.5% foreign transaction fee with the card, so you’re likely better off using a no foreign transaction fee card instead for purchases in US dollars.

Additionally, Rogers is no longer charging an annual fee on the card, which is down from the $29 (CAD) it previously levied.

The cash back earned on the card can then be used to offset any purchase; however, if you want more bang for your buck, you can use the cash back to pay for a Rogers bill and get 30% more value. That means you’ll get $1.30 (CAD) for every cash back dollar applied towards your Rogers bill or on phone and accessory purchases.

Therefore, if you use your cash back to pay for your Rogers bill, you’ll effectively get 2.6%…

Click Here to Read the Full Original Article at Prince of Travel…