Aside from accumulating points that can be used for travel, you’ll need to make sure your cash reserves are healthy, too. Cash back credit cards can be a good option, but there’s another often-overlooked avenue offered by the same institutions: bank account bonuses.

Banks occasionally run promotions in which they give welcome bonuses when you open a new chequing account. These promotions are a good way to keep the awards flowing in from many different avenues.

What Are Bank Account Bonuses?

Chequing bonuses mirror the familiar model for credit card offers: receive a lump sum award upon fulfilling a set of conditions. Bonuses are typically in the $300 range, almost always as cash.

Instead of a minimum spending requirement, chequing accounts might ask you to make a bill payment, set up a pre-authorized payment, or set up a direct deposit. Most promotional offers ask you to complete more than one of these tasks, often on a recurring basis. Generally these are the “big three” requirements, although there are sometimes other conditions.

Bill payments are “push” payments, initiated from your online banking. To make a bill payment, enter the account number for the payee on the bank’s interface. They’re the easiest condition to meet – if you’re collecting credit card rewards, a payment to any of those cards would qualify.

Note that internal transfers from chequing to a credit card at the same bank don’t count. For example, paying your HSBC World Elite Mastercard statement from your HSBC chequing account wouldn’t meet the bill payment requirement.

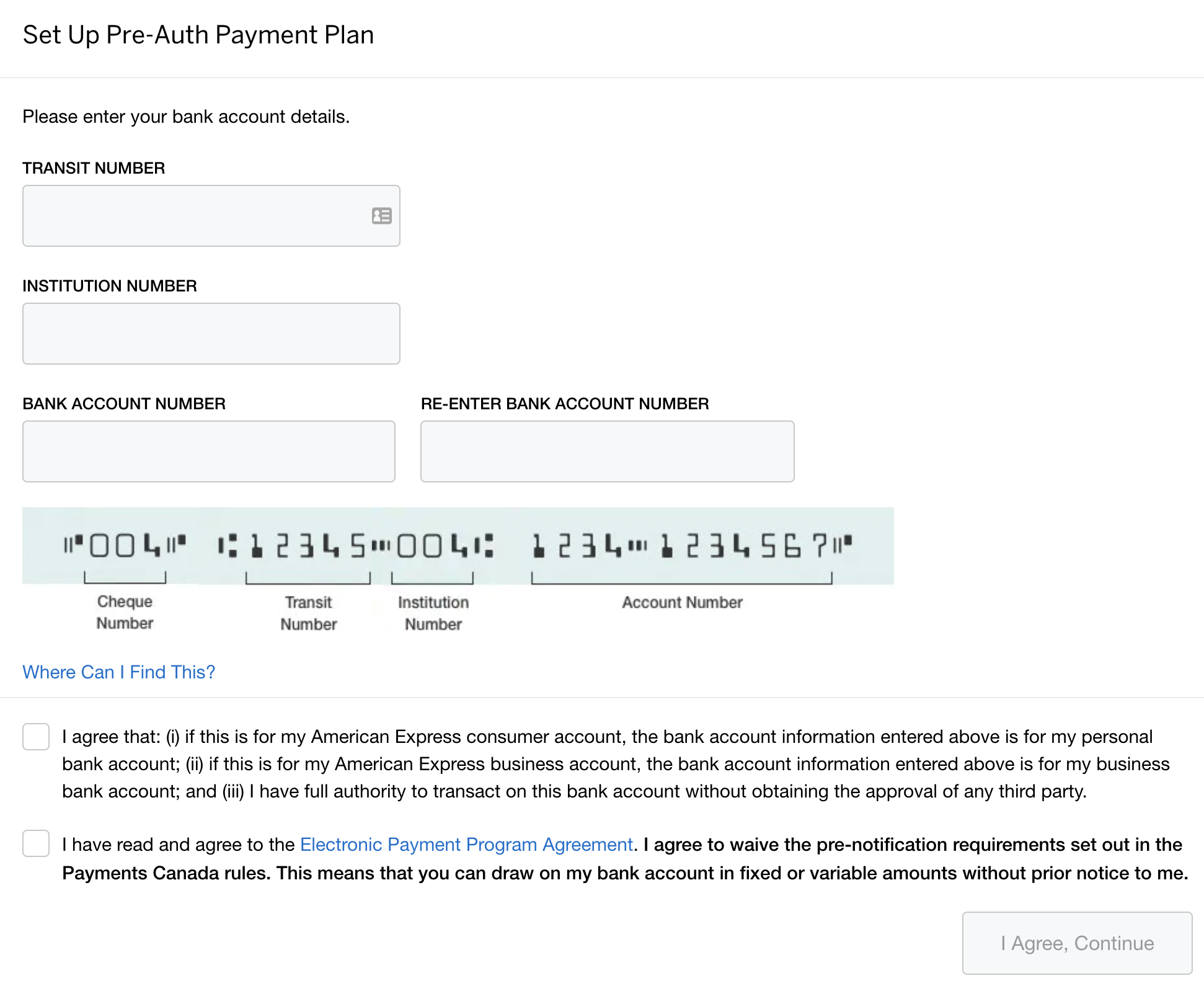

Pre-authorized payments are “pull” payments, initiated from the external body receiving the payment. To set this up, enter your chequing account’s transit number on the external payee’s interface.

Some billers that allow this include utility providers, telecom companies, and American Express credit cards. Any of these can also be “pushed” via bill payment as well.

Sometimes there is a minimum amount for pre-authorized payments. For instance, a BC Hydro bill of $17/month can’t be used it to qualify for banking offers that require at least $50 per pre-authorized payment.

Direct deposit specifically refers to a type of incoming payment that your bank recognizes as a payroll deposit. Income that serves a similar purpose, such as a pension or government benefits, would also register the same way.

Other…

Click Here to Read the Full Original Article at Prince of Travel…