Welcome back to our series on how to leverage credit card multipliers to maximize your earning potential. In Part 1, we focused on cards issued by American Express.

American Express is a great bank to accumulate points with because of its vast array of transfer partners available through American Express Membership Rewards. It also has co-branded cards with Air Canada, making it easy to accumulate Aeroplan points, a major player in our Canadian landscape.

Unfortunately, not all retailers accept Amex, given that it tends to levy higher merchant processing fees. Undoubtedly there’ll be times you’ll have to pull out a Mastercard or Visa, so in Part 2 of this series, we’ll now look at category earning multipliers on cards issued by other banks.

For simplicity’s sake, we’ll only focus on Canadian cards that earn airline points currencies or their equivalent, as opposed to cash back cards or other fixed-value points currencies.

Canadian Banks with Airline Partners

American Express has the most flexibility when it comes to transfer partners, with a total of six airline partners and two hotel partners. However, there are still some good Visa and Mastercard options.

In Canada, RBC, HSBC, CIBC, and TD all have credit cards with which you can earn airline points.

RBC

RBC offers a few credit cards that can earn airline currencies directly:

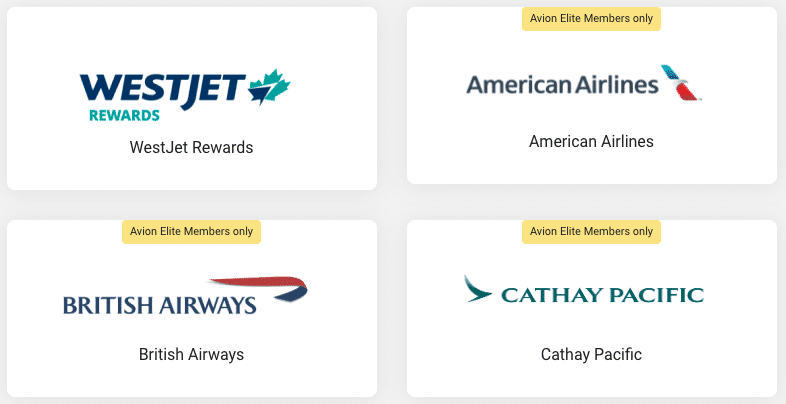

RBC also has its own line of Avion credit cards that earn RBC Avion points, which can be transferred to four airline partners.

The transfer ratios from RBC Avion to the airline currencies are as follows:

|

RBC Avion Transfer Partner |

|

|

British Airways Executive Club |

|

|

Cathay Pacific Asia Miles |

|

|

American Airlines AAdvantage |

Keeping these partners and ratios in mind, let’s look at what the credit card multipliers are, if any:

RBC earning rates are pretty easy to remember. Other than the premium cards and money spent on airlines, you’ll earn 1 point per dollar spent. The exceptions would be the WestJet RBC World Elite Mastercard which earns 1.5% WestJet Dollars on regular spending, and the RBC Avion Visa Infinite Card, which earns 1.25 points per dollar spent on travel.

For a higher base earning rate of 1.25 points per dollar spent, grab a premium card, but be sure you can justify the higher annual fee (perhaps by redeeming for business class flights at 2 cents per point).

HSBC

HSBC offers their own group of Mastercards that earn HSBC Rewards points,…

Click Here to Read the Full Original Article at Prince of Travel…