Bank of Montreal (BMO) has just launched the new BMO eclipse rise Visa* Card to round out its “eclipse” product lineup.

The BMO eclipse rise Visa* Card is now open for new applications, and below, we’ll go other the details about what you can expect in terms of annual fee, welcome bonus, perks, and benefits.

The New BMO eclipse rise Visa* Card

On December 14, 2023, BMO officially launched its newest credit card.

The BMO eclipse rise Visa* Card is the third eclipse product from Bank of Montreal, filling in the entry-level position, with the BMO eclipse Visa Infinite* Card and the BMO eclipse Visa Infinite Privilege* Card rounding out the lineup.

This card that has no annual fee and no minimum personal income requirement. The welcome bonus on the card is up to 25,000 BMO Rewards points in the first year, structured as follows:

- 20,000 points upon spending $1,500 (all figures in CAD) in the first three months of card membership

- 2,500 points if you redeem at least 12,000 points annually towards your statement credit using Pay with Points

- 2,500 points for paying your full credit card balance on time for 12 consecutive months

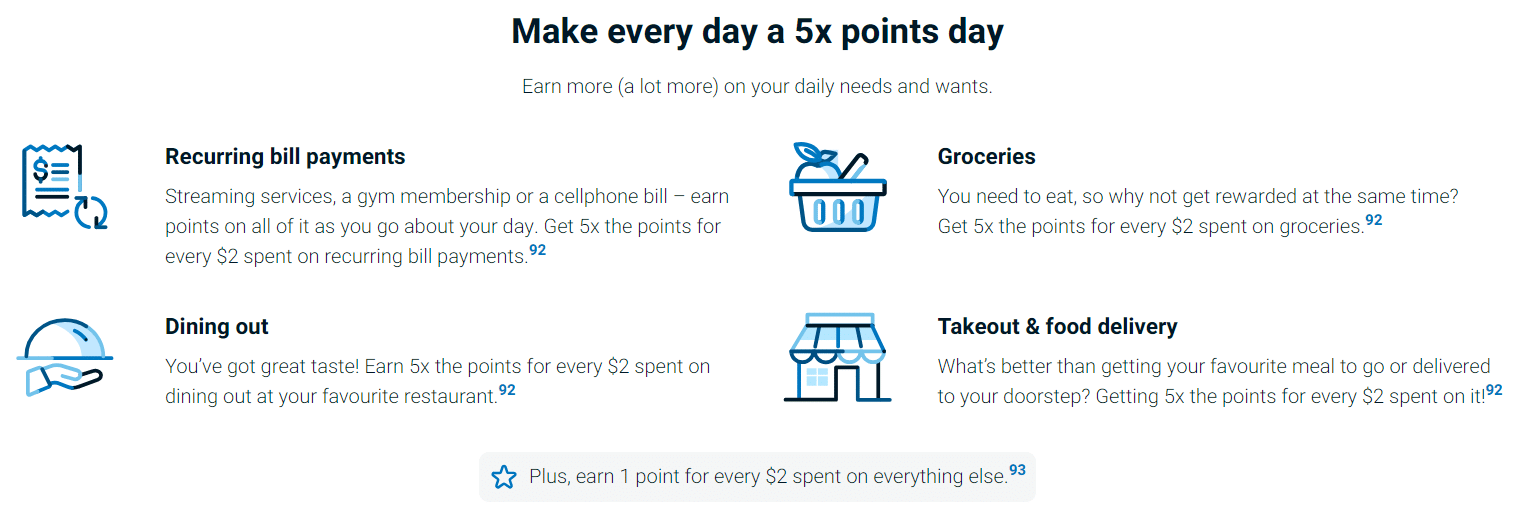

The earning rate for the BMO eclipse rise Visa* Card are as follows:

- 5 points per $2 spent on recurring bills, groceries, dining, and takeout

- 1 point per $2 spent on every other eligible purchase

In terms of perks and benefits, the BMO eclipse rise Visa* Card offers fairly little, as you might expect from a no-fee card.

As a cardholder, you can earn 10% more points when you add an authorized user to your account, and the card offers potential discounts on car rentals.

The card also comes with some very basic insurance coverage for your mobile device, covering you up to $1,000, and it extends some purchase protection and extended warranty opportunities.

How Does This Card Stack Up to Other BMO Cards?

The BMO eclipse rise Visa* Card is a no-annual-fee credit card that lets you collect BMO Rewards points. Beyond earning points, the card doesn’t offer much in the way of perks and benefits.

Within the BMO eclipse product line, there are two other cards on offer, so let’s take a look at how the new card compares against its higher-end counterparts.

First, the BMO eclipse Visa Infinite* Card has an annual fee of $120 and has a personal minimum income requirement of $60,000 and household minimum income requirement of $100,000.

This card earns BMO Rewards…

Click Here to Read the Full Original Article at Prince of Travel…