One of the things that we, Filipinos, need to take care of before any international trip is the travel tax. But did you know that not all travelers have to pay this? Certain types of travelers are eligible for exemption or reduced rate. In this article, we’ll tackle all these, so read on!

WHAT’S COVERED IN THIS GUIDE?

What is travel tax?

The Philippine travel tax (or simply “travel tax”) is a levy collected from travelers leaving the Philippines. Sometimes, it is already included in your flight booking. Most of the time, you need to settle this on your own at the airport.

But this amount doesn’t go to the airline. It goes to the Philippine government:

- 50% of the proceeds to the Tourism Infrastructure and Enterprise Zone Authority (TIEZA)

- 40% to the Commission on Higher Education (CHED)

- 10% to the National Commission for Culture and the Arts (NCCA)

How much is the travel tax?

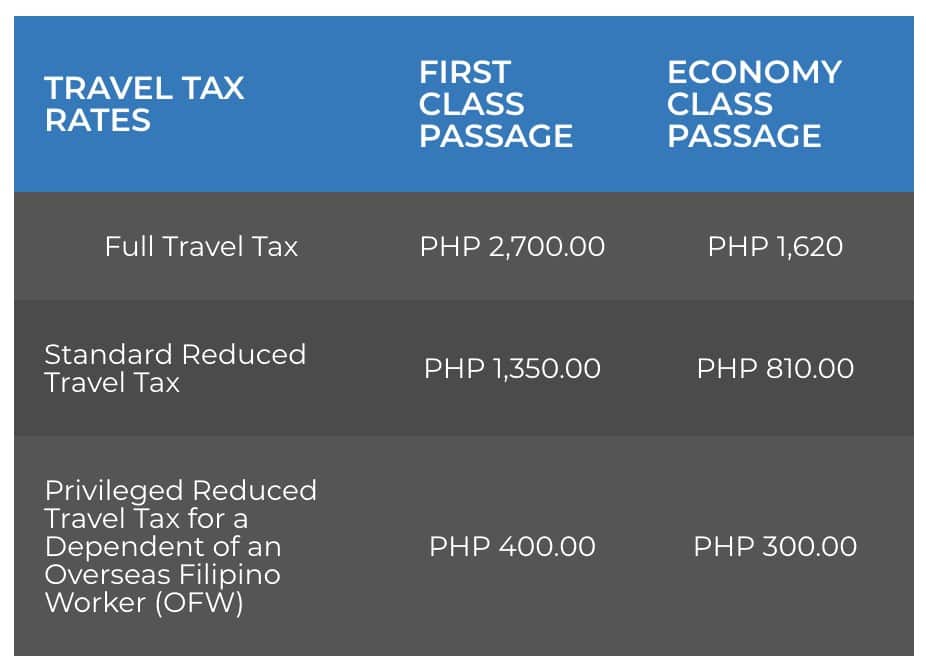

In most cases, the travel tax costs PHP 1,620 for economy class passengers or PHP 2700 for first class passengers.

I say “most cases” because some types of travelers are eligible for lower or reduced rates.

Here’s the price matrix:

So who can avail of the reduced travel tax?

REDUCED Travel Tax Eligibility & Requirements

Travelers falling under eligible classes can pay reduced or discounted travel tax instead of the full amount. There are two main categories: STANDARD reduced travel tax and PRIVILEGED reduced travel tax.

To avail of the reduced rates, you may apply online or on site:

- If you don’t have a flight ticket yet, accomplish this TIEZA form online.

- If you’ve already booked your flight, you may file at any TIEZA travel tax office including the travel tax counter at the counter.

Here are the eligible types of passengers and the corresponding documents you need to present to avail of the reduced rates.

STANDARD Reduced Travel Tax

CHILDREN: 2 years and 1 day to 12 years old

- Original Passport

- Flight booking confirmation, if issued

- If the original passport can’t be presented, submit original birth certificate and photocopy of identification page of passport

Accredited Filipino journalists on assignment

- Original Passport

- Flight booking confirmation, if issued

- Certification from the Office of the Press Secretary

- Certification from the station manager or editor

Individuals with authorization from the President

- Original Passport

- Flight booking confirmation, if issued

- Written authorization from the Office of the President

PRIVILEGED…

Click Here to Read the Full Original Article at The Poor Traveler Itinerary Blog…