American Express has released one of its more aggressive promotions to turn Membership Rewards points into statement credits, the likes of which we haven’t seen since the summer of 2020, albeit on a targeted basis.

Targeted: Redeem MR Points for Statement Credits at 1.2cpp or 1.5cpp

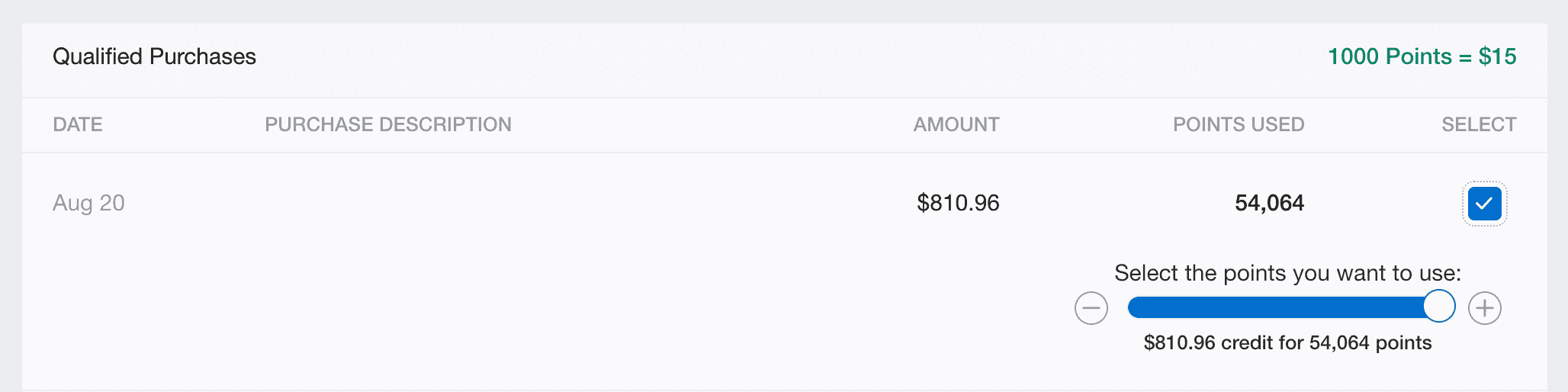

Until September 30, 2022, select American Express cardholders can redeem Membership Rewards (MR) points against statement purchases at a rate of 1.2 or 1.5 cents per point (cpp). Thus, 1,000 MR points could be turned into either $12 or $15, depending on the verbiage of the offer you’ve received.

Of course, this promotion is for a limited time only, and appears to be designed to incentivize cardholders to clear large amounts of points from Amex’s books. Still, this is one of the most lucrative redemptions for cash equivalents that we’ve seen for years.

The higher offer for 1.5cpp has been received by select holders of the American Express Platinum Card and the American Express Business Platinum Card.

The lower offer, but still elevated from the norm, can be found on the American Express Cobalt Card for those who were targeted.

To check if you’ve been targeted for the promotion, visit the “Use Points for Purchases” section of your Amex dashboard. If you see a ratio of “1,000 Points = $15” or “1,000 Points = $12”, you’ve been targeted for the elevated redemption rate.

Otherwise, you’ll continue to see “1,000 Points = $10” as the standard rate for redeeming points for statement credits.

There’s also scope for the promotion to be more useful to cardholders of other American Express cards, because it’s possible to link your MR points together from different American Express cards.

Thus, if you’ve been selected for this promotion, you could redeem the points that you’d earned through spending or welcome bonuses on, say, the American Express Gold Rewards Card, at the elevated offer specific to its Platinum cousins.

Before you ask – nobody knows exactly what logic goes into determining which cardholders are targeted for this promotion. You either get it or you don’t, and there’s no way of determining why that’s the case.

Should You Redeem for Statement Credit or Transfer to Partners?

Before taking advantage of this limited-time offer, consider whether it’s truly worth it to you as a consumer. Getting a redemption rate above the normal 1cpp certainly isn’t a…

Click Here to Read the Full Original Article at Prince of Travel…