As you look to earn rewards faster, you may find yourself working your way through various credit cards until you find one that fits best. Programs like Aeroplan have many cards and partners, and you can accelerate your progress from a variety of sources.

Eventually, though, you might run out of personal credit cards to apply for, and at that point, it’s time to turn to business credit cards. Often overlooked, they can fit very well with your strategy as a valuable source of points. In fact, many of the welcome bonuses are highly competitive with premium personal cards.

But what if you don’t own a business? Fear not, as these cards aren’t as hard to get as you may think.

Who Can Get a Business Credit Card?

There are two types of business credit cards: small business cards, and commercial (or corporate) cards.

Commercial cards are issued by a company to its employees, and the company is directly responsible for expenses. The issuing bank provides the cards in accordance with its commercial lending standards.

For smaller companies, there’s a separate class of cards available to business owners, but issued by personal lending standards. You can qualify based on personal income, instead of business income.

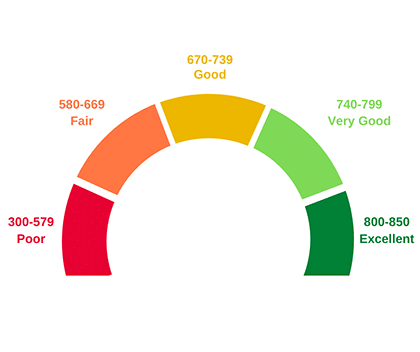

Any debts on the card are the personal responsibility of the cardholder. Also, in Canada, the bank runs a personal credit check before approving the card, and the card reports to your personal credit file.

As far as banks are concerned, business cards are just another tier of qualification requirements, like Visa Platinum, Visa Infinite, or Visa Infinite Privilege, and the cards don’t work any differently from personal credit cards. But instead of asking for a high personal income, they ask for various documents depending on the structure of your business.

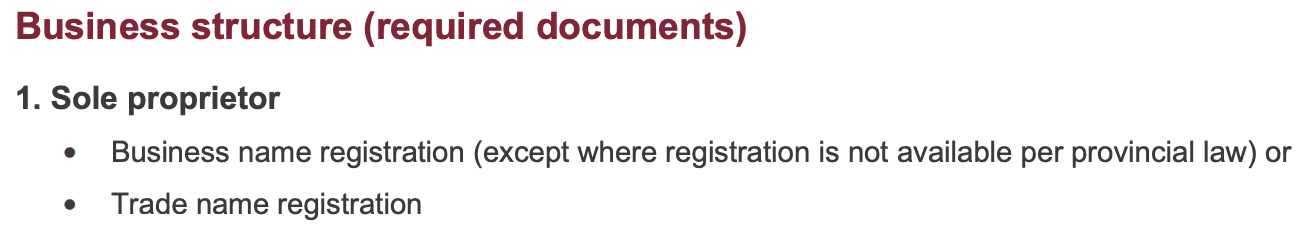

These cards are available to any type of business, including sole proprietorships, partnerships, corporations, and non-profits. Sole proprietorships are by far the easiest and cheapest type to register, and the easiest for credit card approvals.

Often, you’ll only be asked to prove your business registration. For example, here’s CIBC’s list of required documents for sole proprietors:

On the other hand, corporations need to show their finances and articles of incorporation. You might expect that it’s easier for larger, established businesses to obtain credit – in fact it’s quite the opposite.

Here’s…

Click Here to Read the Full Original Article at Prince of Travel…