The economy seems to be a constant source of discussion these days. Wherever one looks, there’s a new report of a big bank going bust, or a tech company on the AI hype train riding the wave to previously unimaginable stock prices.

Whatever the case may be, it seems that the financial technology space has not been trending in the right direction ever since the closure of Silicon Valley Bank, which backed many such projects.

The latest casualty of the fintech crunch appears to be Plastiq, a company famous in the Miles & Points community both for its enabling of consumers to pay for just about anything (including taxes and rent) via credit card, as well as for its generous promotions.

Let’s take a look at what befell this former titan of the Canadian Miles & Points scene.

Plastiq Files for Chapter 11 Bankruptcy Protection

Plastiq recently filed for Chapter 11 bankruptcy protection in Delaware. What this means is that the company is slated to continue operations, so long as they find a willing buyer – and fortunately for Plastiq, they already have one lined up, but more on that later.

The reason many Miles & Points enthusiasts are likely to remember Plastiq (which either rhymes with drastic or mystique, depending on who you ask) is because of the great value the company has provided to the community in the past.

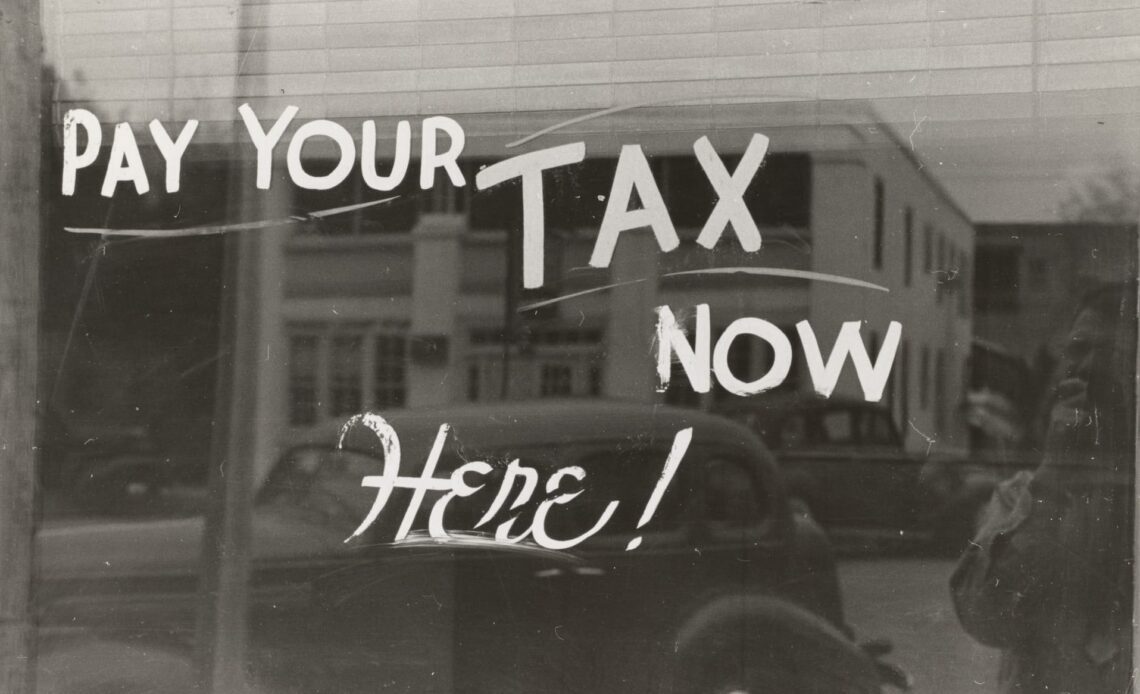

Plastiq’s success among consumers was because it offered the ability to pay virtually any bill with a credit card, including on transactions that were notoriously difficult to pay with a credit card, such as taxes to the Canada Revenue Agency or rent to large property companies.

This meant that it was easy for Miles & Points aficionados to rack up points by paying for almost anything via credit card, so long as they were willing to part with a small transaction fee. Over time, this fee went up from a low of 2.1% a few years ago and worked its way up to Plastiq’s most recent transaction fee of 2.9%.

Initially, Plastiq often provided generous promotions, which included Fee-Free Dollars (FFDs) for new users and through referrals. Once earned, FFDs could be used to offset the transaction fee levied by Plastiq.

This helped us side-step the need to pay extra fees to put anything on our credit cards, which was a fantastic way to keep costs down.

And perhaps, therein lay the problem. Since Plastiq…

Click Here to Read the Full Original Article at Prince of Travel…