Finance has evolved a lot over the past centuries.

The Greeks were the first to mint coins so merchants could use a common medium of exchange. In the Middle Ages, the infamous Knights Templar invented modern banking deposits by inventing promissory notes exchangeable at any chivalrous chancellery. Later, the Dutch invented fractional reserve banking, a facet of all modern finance.

Jumping forward to the present day, one of the more recent breakthroughs in the global financial revolution has been the credit card, which allows customers to spend a creditor’s money while promising to pay them back.

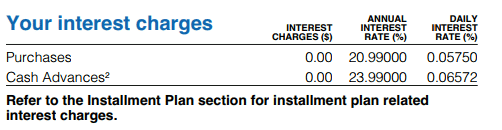

Of course, nothing in this world is free, and credit card issuers expect to make money back on any that they lend, and the most common way that lenders recoup their investments is by collecting interest on outstanding balances.

Today, let’s take a look at the enigma of credit card interest.

What Is Credit Card Interest?

Credit card issuers make money in one of two ways. The first is via interchange fees, also known as swipe fees, whereby merchants who accept credit cards are charged a set fee based on the size of the transaction.

Swipe fees are an easy way for issuers to make money because most merchants nowadays take credit cards; however, this method is not nearly as lucrative as the other way that credit card issuers make money.

Charging fees to cardholders on their unpaid balances, through the dreaded credit card interest, makes lenders large sums of money. In fact, the sums are large enough that the interest paid by customers who carry a balance, in turn, pays for the rewards we derive from our Miles & Points hobby.

Credit cards are unsecured lines of credit, which is a fancy way of saying that they are backed by nothing more than the credit card issuer making an educated guess (based on factors such as income and credit score) that the borrower will be able to repay any money loaned to them.

However, because the issuer usually doesn’t require collateral, such as a vehicle, home, or a deposit of cash, before agreeing to lend the money, they want to mitigate the risk of a cardholder absconding with the funds by charging a higher interest rate than secured lines of credit.

If a borrower has previously run into financial difficulties, they may not be granted an unsecured credit card. Rather, they’d instead be required to open a secured credit card that necessitates they provide a…

Click Here to Read the Full Original Article at Prince of Travel…